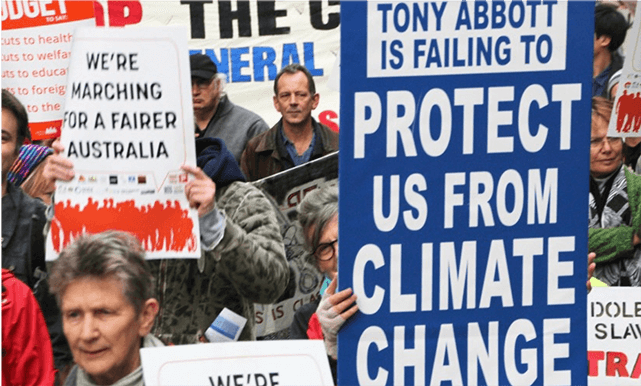

In a regressive move, the Australian government followed through with its plan to abolish the country’s hard-fought carbon tax. As of July 1, the Australian carbon tax has been officially repealed.

No doubt it was a major setback. But as far as investors in the country are concerned, putting money into environmentally and socially responsible assets is becoming increasingly attractive.

According to a report from the Responsible Investment Association of Australasia, such assets under management continued to grow strongly in 2013 “due both to strong performance and increasing fund inflows.”

In fact, taken together – including ethical, socially responsible, community finance and other sustainability themed investments – the value of responsible assets under management grew by 51 per cent in 2013 to more than $25 billion.

At the same time, more asset managers are integrating environmental, social and governance practices into how they manage assets, which increased 13 per cent over the year to roughly $153 billion.

The association also found that core responsible investments – primarily equities and balanced funds – have outperformed benchmark indices, such as the ASX 300 and MSCI.

“This report again puts to bed the old fashioned myth that responsible investments are the underperforming younger brother of mainstream investments,” the association said. “When compared to benchmark indices and the average returns of mainstream funds, core responsible investment funds have outperformed across the majority of fund categories and time horizons.”

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff

- CK Staff