The nuclear power industry is gearing up for yet another renaissance in Canada, but concerns loom over whether Ontario’s new generation of nukes, including small modular reactors (SMRs), can deliver the safe and affordable electricity as promised.

Prime Minister Mark Carney and Ontario Premier Doug Ford have made common cause in promoting nuclear energy. Indeed, the prime minister has indicated that the federal climate strategy relies on construction of low-carbon power for a national electrification effort, and nuclear is central to that vision.

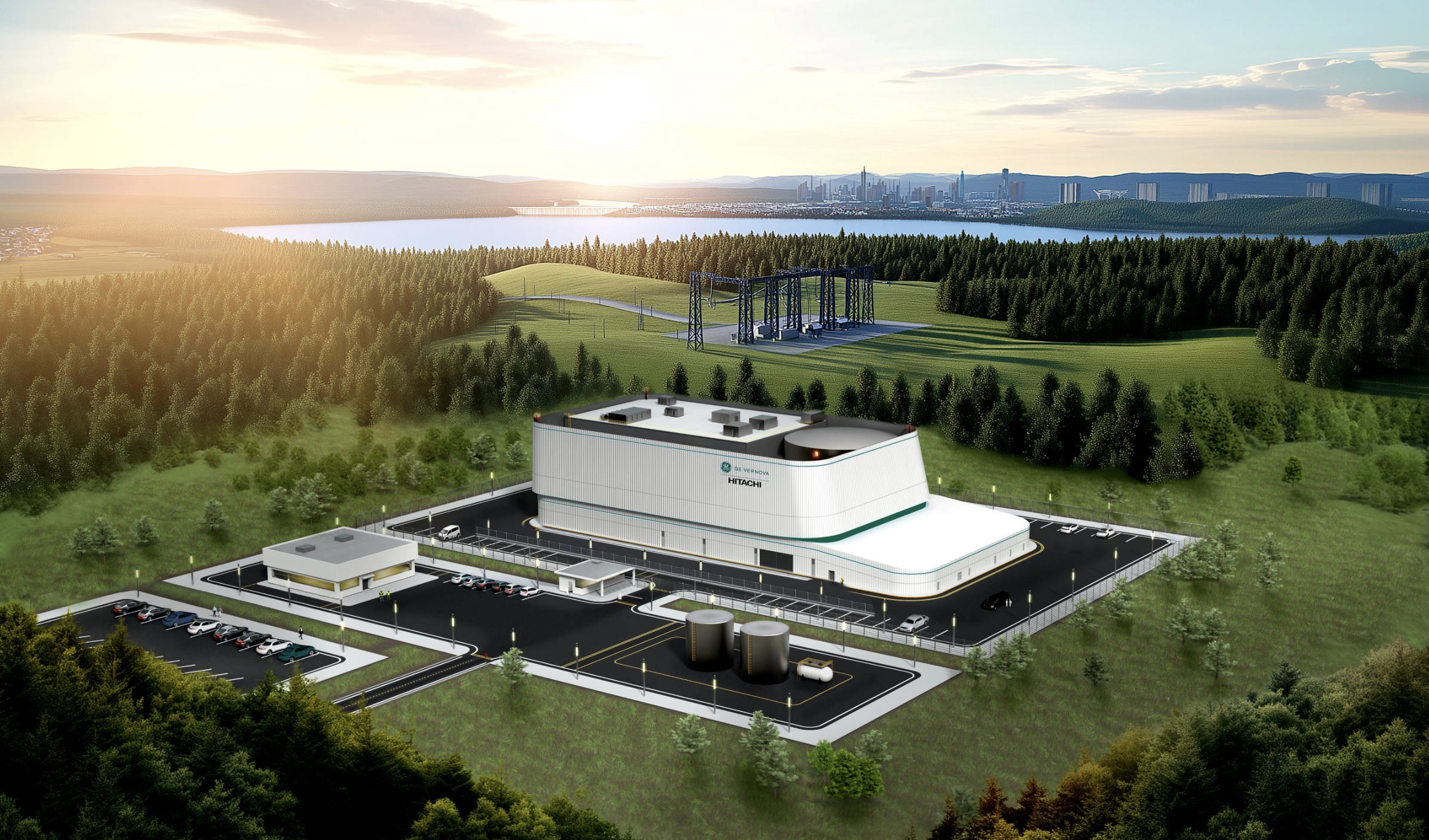

This fall, Carney and Ford together announced $3 billion in funding for Ontario’s purchase of four BWRX-300 SMR reactors from Hitachi GE Vernova, a joint Japanese and U.S. company. Ottawa will shoulder $2 billion of that amount through the Canada Growth Fund. In a news release, the two leaders boasted that Canada will become the first Group of Seven country to build an SMR reactor. The prime minister said the federal investment “will extend Canada’s world leadership in clean energy.” Ontario is also pursuing plans to build large-scale reactors.

However, critics argue that the industry’s cost estimates are unreliable. They point to overruns and delays at other “first of a kind” nuclear installations. At the same time, Ontario will rely on a U.S.-based supplier of enriched uranium to fuel the SMRs, unlike its current fleet of Candu reactors that run on non-enriched Canadian sources.

“They’re taking a flyer off Mount SMR and the world is sitting back to see how much of a splat there is,” says Mark Winfield, a professor of environmental studies at York University. The reliance on a U.S. fuel supplier “makes absolutely no sense given our quest for energy independence and security,” he adds.

Pitting nuclear against renewables

Provincially owned Ontario Power Generation (OPG) plans to purchase four Hitachi GE reactors for $20.9 billion, although it has committed to only one at a price of $7.7 billion, including $1.1 billion for infrastructure that would serve all four units.

In addition to the direct support, OPG will benefit from federal investment tax credits of 15% that support investment in clean electricity. The tax credits will be paid out in cash to provincial and municipally owned utilities that are not taxable.

OPG received a construction licence for the SMRs last April from the Canadian Nuclear Safety Commission. It is now preparing the ground at its Darlington site, which currently hosts four larger Candu reactors that have been refurbished in a decade-long, $12.8-billion project that was completed on time and on budget.

OPG cites work by the province’s Independent Electricity System Operator (IESO) to back its bet on SMRs as a cheaper alternative to hybrid options of wind, solar and batteries to supply an additional 2,200 megawatts of low-carbon, baseload power. An IESO paper released in August concluded that it would cost up to $34 billion to meet additional baseload demand with SMRs, while a hybrid renewable system would cost $47 billion. Wind and solar would also entail more transmission and land development costs, the IESO said.

Nuclear facilities operate at far higher capacity factors and, unlike wind and solar, the electricity is constantly generated. IESO assumes that nuclear plants operate at 93% capacity, while that figure for wind is only 38% and for solar, 24%.

OPG also defends the nuclear option by pointing to the large supply chain and workforce in the province that is currently focused on refurbishments at its Pickering site and at Bruce Nuclear and will benefit from further investment in reactors. However, critics argue that cost estimates for nuclear are notoriously unreliable, especially for first-of-a-kind projects like OPG’s deal for the BWRX-300. There have been SMRs of different designs built in the world: two in Russia, one in China and one in Argentina. In every case, there were delays and higher-than-promised costs.

How transforming Canada’s electricity grid could drive decarbonization, save billions

The Crown utility – and ultimately Ontario ratepayers and taxpayers – will be responsible for any cost escalation in the SMR deal.

A report prepared for the Ontario Clean Air Alliance compared the levelled cost of power – that is, the average cost of electricity generation over the plant’s lifetime. It concluded that, in 2030, electricity from SMRs would cost up to US$174 per megawatt/hour, while wind would be $93 and solar would be $41. Those costs do not include transmission or land development, nor do they account for capacity factors.

Ralph Torrie, research director for Corporate Knights, weighed capital costs for the nuclear options against alternatives in his Climate Dollars project, which provides a decarbonization analysis for each province. The report concludes that the upfront investment for reactors would far exceed the cost of renewables plus efficiency and other demand-management strategies.

“Public investment in new nuclear plants has a double-barrelled negative effect on addressing greenhouse gas emissions,” Torrie says in an email. “It diverts capital from efficiency and renewables that would increase the supply of emission-free electricity faster than nuclear at a lower cost and with less risk.”

“The government subsidies for nuclear expansion are driving electricity price increases in Ontario,” he adds, “and that slows down the switch to electricity that we need in buildings and vehicles to give our children and grandchildren a fighting chance against climate change.”

Shawn McCarthy is an Ottawa-based writer and senior counsel with Sussex Strategy Group.

The Weekly Roundup

Get all our stories in one place, every Wednesday at noon EST.