Like many Canadians, Gene Chartier thinks a lot about retirement. As the co-owner of Paradigm Transportation Solutions Ltd., a traffic engineering and transportation planning firm based in Cambridge, Ontario, his retirement planning involves thinking about not just his own future, but that of his company and its 30-plus employees.

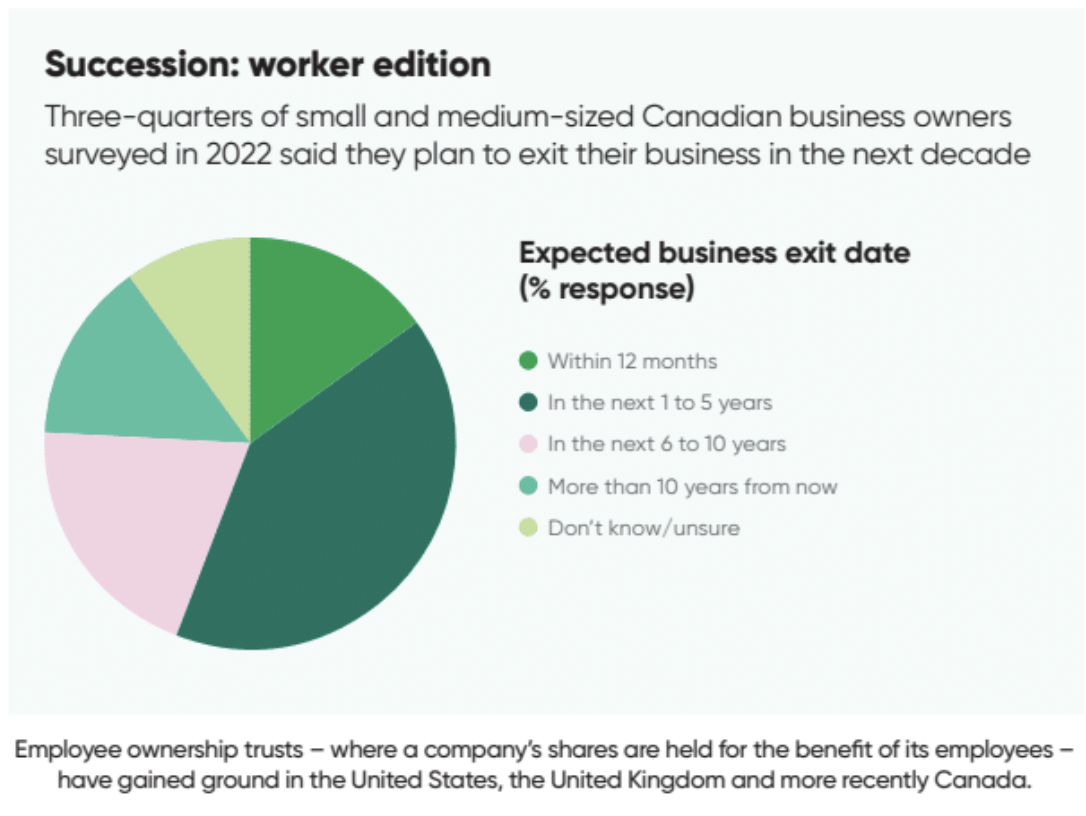

According to the Canadian Federation of Independent Business, 76% of Canadian small-business owners plan to exit their businesses in the next decade, most of them to retire. Roughly 2-trillion dollars in business assets could change hands. But only 10% of these business owners have a succession plan. Some businesses will wind down, others will be sold to management or to a third party or be bought by private equity. The scale of the shift could significantly affect the country’s business landscape and have a lasting impact on Canadian workers and communities.

After spending 25 years building Paradigm, Chartier and his business partners want to ensure that the company continues to thrive after they retire. “We didn’t want to sell to a big company or to private equity. We were concerned about all the horror stories we’ve heard about losing corporate culture,” Chartier says. “We want the company to keep going and leave it in the hands of the people that helped us make it what it is.”

The company launched an employee share ownership program in 2021, but uptake was limited because its 30- and 40-something staff’s household budgets were tied up in mortgage payments and daycare costs. And a management buyout wasn’t in the cards.

So Chartier and his partners began exploring a transition to an employee ownership trust (EOT) model. The federal government had amended the Income Tax Act in 2024 to enable EOTs and announced a temporary $10 million capital gains tax exemption for qualifying business transfers between January 2024 and December 2026 to create an incentive for business owners.

An EOT is a model in which a trust holds a company’s shares for the benefit of its employees. The employees don’t buy shares from the company; instead, in a succession scenario, the trust finances the purchase from the owner and shareholders. The owner is paid back over time instead of all at once. And employee-owners receive profit-sharing, which enables them to build wealth and equity in the company they work for. Evidence from the United States and the United Kingdom, which have both promoted the model for some time, shows that EOTs increase productivity, resilience, entrepreneurship, and employee retention and wealth. Supporters of EOTs in Canada say encouraging the model here could also keep more companies in Canadian hands.

“It really made perfect sense for our company,” Chartier says. “It aligned with our philosophy of employee ownership, our business size and what we anticipated our value to be.” Paradigm fully transitioned into an EOT on January 1, 2026. “The tax exemption was a huge benefit and allowed us to close the gap between what we would’ve gotten on the market and what we were able to sell it to the trust for.”

Employee ownership trusts in Canada

Paradigm is one of a handful of EOTs in Canada. Friesens, a book printer based in Altona, Manitoba, was a pioneer in employee ownership in Canada and has been employee-owned since 2010. Grantbook, a strategic tech consultancy, was the first company to become an EOT under the current model in January 2025. In September 2025, Taproot Community Support Services, a 41-year-old B.C.-based company that employs 750 people, became Canada’s largest EOT.

Momentum has been building since the federal legislation took effect in 2024. Tiara Letourneau of Rewrite Capital, a firm that helps companies make the EOT transition, says that more than 80 businesses have approached her to explore the possibility. Transitions can take anywhere from one to two years, depending on the firm. Justine Janssen, interim executive director at Employee Ownership Canada (EOC), says they expect that the number of EOTs across Canada will rise to between 20 and 30 by the end of 2026. “What’s true now that wasn’t true when we started is that there’s a much bigger understanding in Canada about the importance of owning our assets and what that means for economic sovereignty and the overall wealth and strength of the nation,” Janssen says.

Letourneau believes there is urgency in keeping Canadian companies in Canadian hands and believes EOTS could encourage economic activity to flourish in local areas. “Who owns businesses matters,” she says. “If a huge number of our mid-market companies end up being just about the numbers, not about the people, the community or the services they provide, we’re going to change the landscape of what it feels like to be an employee, a consumer and a community member all across this country.”

Supporters of EOTs say the key to unlocking more transitions is to remove the time limit and cap on the tax exemption and to broaden eligibility and who can access those incentives. In the United Kingdom, which introduced EOTs in 2014 and offered a complete and unlimited capital gains tax exemption to business owners selling to an EOT until 2025, the number of employee-owned businesses grew to 2,470 by mid-2025. In the United States, where employee ownership has been a model since the 1970s and where business owners can access a capital gains tax deferral, there are more than 6,500 employee-owned businesses.

However, the future of EOTs – and of those dozens of interested Canadian companies – became more uncertain in November 2025 when the Liberal government presented a federal budget that did not extend the capital gains tax exemption beyond the end of 2026.

“I’ve been getting messages from owners who have been looking at the EOTs and who have to now put that on pause because they won’t be able to get [the transition] done in time,” says Jon Shell, chair of Social Capital Partners, a non-profit that has led the charge on encouraging EOTs in Canada. “Now we’re all holding our breath [until the April 2026 economic statement] because that will determine the path of employee ownership in Canada.”

Watchers have speculated about the reasons the government didn’t jump on what some consider an easy win that would cost taxpayers little and would have provided a good-news story for Canadian-owned businesses at a time when they’re in short supply. Maybe the issue got lost in the shuffle of the big-ticket items in the Liberals’ long-awaited budget. Maybe the Department of Finance opted to be fiscally prudent about reductions to tax revenue at a time of economic uncertainty. Or maybe the government chose to defer the decision until closer to the December 2026 end date. Whatever the reason, many fear that the lack of clarity will slow momentum at a time of significant transition for Canadian businesses.

“It has probably put sand in the gears of EOT conversions and will delay any early momentum there was towards EOTs, which I think is quite regrettable because it’s a no-brainer,” says former Alberta premier Jason Kenney, a proponent of EOTs. “It has all the parties’ support, and it aligns perfectly with the government’s strategy of strengthening the Canadian economy and retaining capital in Canada.”

How EOTs build wealth and engagement

Andrew Achoba has been working at Taproot Community Support Services for more than seven years, running family support programs in northern Alberta. When Taproot transitioned to an EOT in fall 2025, Achoba became a trustee. He and Taproot’s two other trustees represent the interests of the company’s 750 employee-owners, working with leadership to ensure the sound management of the company.

Achoba says he often gets questions from friends who can’t believe he became an employee-owner without having to make a financial investment. He believes EOTs are an important vehicle for employee wealth-building at a time of increasing economic precarity – especially for those earning hourly wages or in lower salary brackets. “We’re seeing the price of things go up and the affordability rate going down. Any extra money that can go to the individuals doing the hard work, I think, is important.”

A 2025 Harvard Business School report, The Possibilities of Worker Ownership, cited a 2017 finding from the National Center for Employee Ownership (NCEO) that employee-owners in the United States reported 92% more wealth than people working in non-employee-owned businesses. In the United Kingdom, a report found that employee-owned businesses were 8% to 12% more productive than comparable businesses, and regional studies showed that EOTs are more stable in downturns and report fewer layoffs. There is also evidence that EOTs can encourage greater business skills development, deepen employees’ commitment to the business and expand entrepreneurship.

Achoba is seeing some changes firsthand. “We’re seeing a very high level of ownership among staff now. People are more responsible because they have a collective vision for the agency.”

Prior to becoming an EOT, Taproot was owned by a small group of about 30 shareholders, many of them former employees who had retired and wanted to sell their shares. CEO Michael Fotheringham says leadership explored several models, including selling to a third party, a management buyout and expanding its ESOP model beyond the current owners. The EOT model was the simplest option and the one most aligned with the company’s values. The capital gains tax exemption was a key factor in the company’s decision to move forward.

In Taproot’s model, every employee has an equal ownership share in the company. “Now, when I meet with my employees, they’re my owners, so I have this built-in check and balance every day,” Fotheringham says. “That changes some of the traditional dynamics that I think need to change anyway. It‘s a democratization of the workplace, so to speak.”

At a time when all eyes are on how Canada will respond to economic and political headwinds it faces, proponents of EOTs hope that leaders will consider the potential of employee ownership and the importance of small- and medium-sized businesses to building individual, community and national economic strength and vibrancy.

“I don’t want us to wake up in Canada a decade from now and find that we’ve watched a hollowing out of what’s left of our industrial heartland because we were unwilling to be creative and ambitious about solutions like this,” Kenney says.

The Weekly Roundup

Get all our stories in one place, every Wednesday at noon EST.