With only two months until election day in the United States, the sustainable finance industry is staring down the grim prospect of more conflict and chaos or cautious optimism and new opportunities.

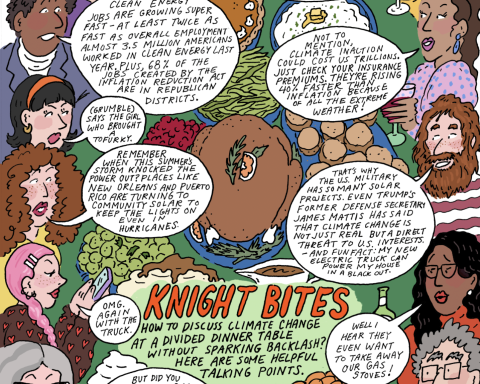

The near-term future of sustainable finance is on the ballot box, with Donald Trump promising to fight environmental, social and governance (ESG) investing, while Kamala Harris would bring policy predictability, working to settle important issues on ESG rights and corporate disclosure. While a Trump victory would threaten $1 trillion in low-carbon investments, Harris would challenge the sector to better address the financing needs of ordinary Americans facing large utility bills or small businesses grappling with rising costs.

Early in the campaign, Trump pledged to “protect Americans from radical leftist ESG investments” and to “set the example for Republicans across the country to follow my lead in fighting ESG.” A Trump victory – especially if Republicans also win control of Congress – would empower the administration to reverse a decade of progress on shareholder rights, attack the right of pension trustees and other fiduciaries to incorporate ESG into pension investments, and revoke requirements on corporations to disclose key information on carbon emissions and their investment risks.

The conservative policy document Project 2025 is a blueprint for how a Republican administration and Congress would dismantle sustainable investing, says Kyle Herrig, spokesperson for the ESG advocacy group Unlocking America’s Future. “The ESG section of Project 2025 will create severe, long-lasting damage to our economy and environment,” he said in a recent statement releasing a report analyzing the document’s recommendations on sustainable finance.

In the last two years, Republicans have mounted a war against ESG investing (calling it “woke capitalism”), prompting many states to boycott ESG fund companies and managers, sometimes at great cost to themselves. These battles are expected to ramp up if Trump wins the presidency and Republicans control Congress.

One of the most significant Project 2025 recommendations is a call to reinstate a Trump-administration regulation stipulating that pension trustees would only be permitted to consider “pecuniary” issues in investment decisions. The rule would overturn a Biden policy specifically permitting trustees to consider ESG issues.

Project 2025 also says the Securities and Exchange Commission (SEC) should revoke a rule requiring publicly listed companies to disclose their operational carbon emissions and climate risks. Project 2025 also recommends enacting legislation to repeal financial-institution disclosure requirements on conflict minerals, mine safety, resource extraction and CEO-to-staff pay ratios. As well, it calls for the federal government to investigate ESG firms on collusion and price-fixing and anti-competitive behaviour – accusations against the industry that have been found to be groundless.

Bryan McGannon, managing director of the US Sustainable Investment Forum, the umbrella organization for the sustainable finance industry, says he is particularly concerned that Republicans will attempt to roll back shareholder rights on ESG and other issues. “Shareholder rights is the thing they will go after, and they have been trying to for ages,” he says.

Last year, Republican members of the House presented a series of bills that would bar investors from presenting proposals on ESG matters for a vote at corporate annual meetings. The bills would roll back SEC reforms from 2009 that enabled investors to submit ESG proposals, shareholder-rights attorney Sanford Lewis said in a blog post.

Since those reforms, shareholder proposals have helped to pressure hundreds of U.S. companies on ESG issues. Many companies have made important concessions on ESG issues as a result of this process. In 2023, for example, New York City pension funds withdrew proposals on labour rights at DoorDash, Walmart and Apple after the companies conceded to policy changes or greater disclosure around their employment practices.

If Republicans are successful in making these bills law, they would remove this important tool from shareholders at a time when many are having critical discussions with companies on climate issues, Lewis said. “In a year of global flooding, wildfires and heat – a climate emergency worldwide – it would silence the voice of investors and ask them to invest as if climate change is not happening.

Corporate disclosure at risk?

On other issues – ESG consideration on pension investments and corporate climate disclosure – McGannon believes a Trump administration would have less power to cause lasting damage than on shareholder rights. It’s unlikely the courts would uphold an outright ban on ESG consideration through a reinstated pension rule, he says, because the financial industry widely accepts the principle that ESG issues hold important pecuniary implications of risk and return. But a Trump rule could succeed in “muddying the waters,” he says, discouraging trustees from adding sustainable investment funds to the list of investment options available to members of some retirement plans.

On carbon dioxide reporting, corporations are facing a growing trend worldwide – in Europe, California, China and elsewhere – to disclose CO2 emissions and risks. While Trump may be able to slow this trend in the United States, he won’t be able to stop it, McGannon says. “The reality is that something like 3,000 U.S. firms – the biggest U.S. firms – will be obligated to disclose [emissions and risks] under reporting frameworks more comprehensive than the U.S. climate rule.”

Harris would bring policy stability

If, on the other hand, Harris pulls off a victory come November, McGannon believes she would uphold the Biden administration reforms in the courts where they are currently under review. However, he also predicts that a Harris administration would not re-enter the policy debates of the last few years by strengthening the rules or adding new ones.

Regardless, McGannon and others think a Harris administration will likely seek to bolster private investment for the climate transition and community development – two important goals of the sustainable finance industry. As a senator, Harris was an early co-sponsor of the Green New Deal, a comprehensive climate and economic package aimed at creating millions of jobs through renewable energy, energy efficiency and retraining for displaced workers.

As vice-president, Harris was Biden’s key representative on the Inflation Reduction Act (IRA), focusing on its funding for community climate initiatives. One IRA program Harris helped to launch was a national green bank to help fund a network of community-development financial institutions. These institutions will, in turn, finance clean power options in low-income and disadvantaged communities. The bank started operations last month with the help of $5 billion in federal funding.

More recently, CNN reported that Harris will announce plans to create a new fund to cover the interest costs of small business loans by community banks and other local lenders. In contrast with her climate-focused announcements, this new initiative would address the needs of small businesses generally, encouraging community lending institutions to expand financing to small local companies.

McGannon says that Harris’s vision fits within a tradition of Democratic policy-making to incentivize private capital for community and economic development, a component of sustainable finance called impact investing. “She hasn’t laid out a whole lot of detail yet for us to think about, but I think it’s smart policy-making to use those levers in the marketplace.”

The outcome of this election will have a big impact on the future of the sustainable finance industry over the next four years, determining whether it wastes more time and effort on Republican culture wars or if it can move on to address questions of real importance to Americans like how to help communities make the switch to clean energy and finance the expansion of small businesses in a low-carbon economy.

Eugene Ellmen writes on sustainable business and finance. He is a former executive director of the Canadian Social Investment Organization (now the Responsible Investment Association).