SUBSCRIBE TO OUR WEEKLY NEWSLETTER

Get the latest sustainable economy news delivered to your inbox.

Meet the latest Global 100 companies driving the transition to a low-carbon, circular economy

With Russia’s war in Ukraine driving energy prices up to record levels and the world experiencing unprecedented climate disasters, it has never been more important for companies to cut their emissions and double down on sustainability.

This year’s Global 100 ranking of the world’s most sustainable companies, now in its 19th year, reveals that the transition is gathering momentum – and that businesses that take sustainability seriously are flourishing financially.

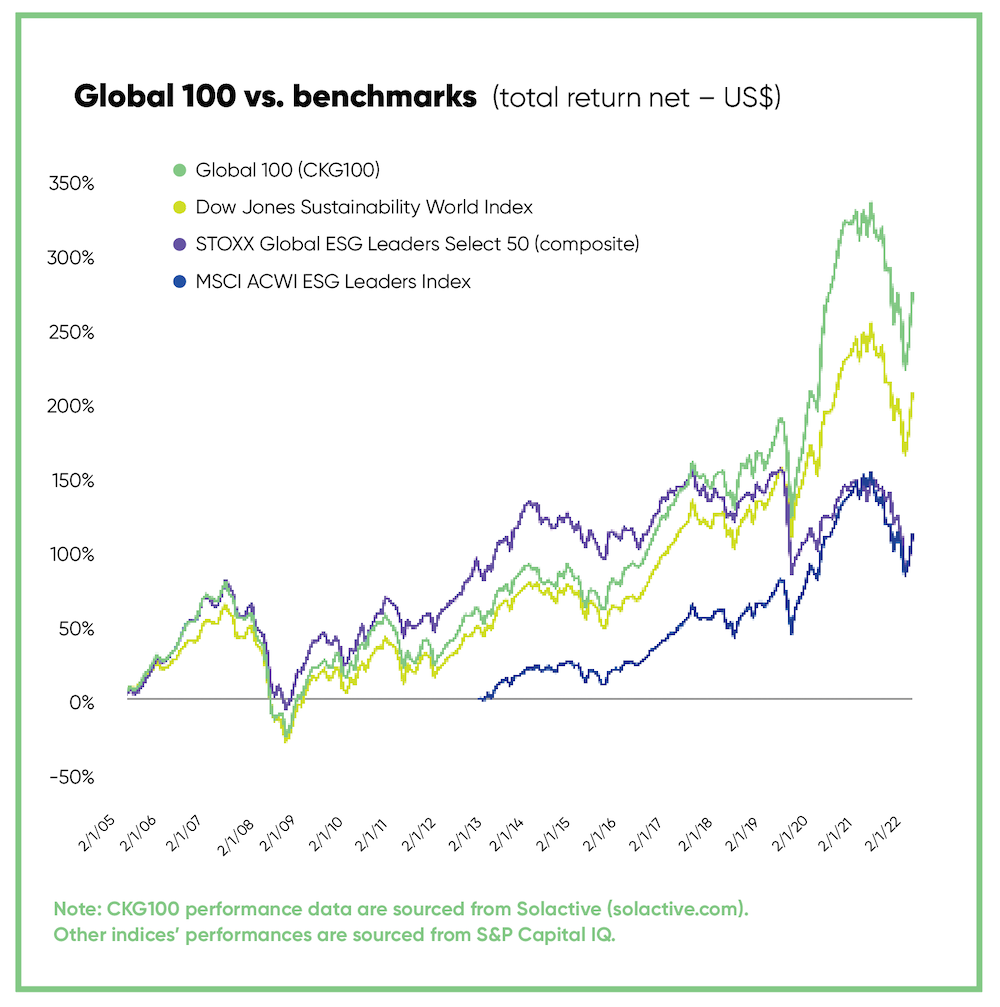

While the Global 100 is light on oil and gas companies, whose profits have soared because of rising energy prices (Finland’s Neste being the only oil company on the ranking), it still managed to outperform its blue-chip benchmark, MSCI ACWI (All Country World Index), and other ESG indices. While both the Global 100 and ACWI fell somewhat in 2022, since its inception on February 1, 2005, the Global 100 Index has generated a total investment return of 270.7% compared to 222.1% for ACWI.

Ralph Torrie, Corporate Knights’ research director, says rising oil prices have stimulated growth in renewables, smart buildings, electric vehicles and other climate solutions, including circular economy measures. Indeed, the top-ranked company, Schnitzer Steel, is a metals recycler. “Global 100 companies are providing the products and services that are needed for the sustainability transition and that will form the basis of the emerging 21st-century economy,” says Torrie. “They’ve outperformed the market through these last few tumultuous years.

| 2023 G100 Rank | 2022 G100 Rank | Company | HQ Location | Carbon Productivity | % Non-Male Board Directors | % Sustainable Revenue | % Sustainable Investment | Final Grade | Climate Commitments |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 15 | Schnitzer Steel Industries Inc | Portland, U.S. | $15,928 | 50% | 100% | 100% | A+ | |

| 2 | 1 | Vestas Wind Systems A/S | Aarhus, Denmark | $222,113 | 42% | 100% | 100% | A | 1.5°C, SBTi |

| 3 | 10 | Brambles Ltd | Sydney, Australia | $156,386 | 40% | 100% | 100% | A | 1.5°C, SBTi |

| 4 | Brookfield Renewable Partners LP | Hamilton, Bermuda | $21,806 | 33% | 99% | 100% | A | ||

| 5 | 3 | Autodesk Inc | San Francisco, U.S. | $456,489 | 45% | 93% | 43% | A | 1.5°C, SBTi |

| 6 | 19 | Evoqua Water Technologies Corp | Pittsburgh, U.S. | $25,868 | 33% | 100% | 100% | A | SBTi |

| 7* | 17 | Stantec Inc | Edmonton, Canada | $95,950 | 33% | 53% | 94% | A- | 1.5°C, SBTi |

| 7* | 4 | Schneider Electric SE | Rueil-Malmaison, France | $142,877 | 50% | 71% | 68% | A- | |

| 8 | Siemens Gamesa Renewable Energy SA | Zamudio, Spain | $514,578 | 30% | 100% | 100% | A- | 1.5°C, SBTi | |

| 9 | Taiwan High Speed Rail Corp | Taipei, Taiwan | $7,051 | 23% | 100% | 100% | A- | ||

| 10 | 9 | Dassault Systèmes SE | Vélizy-Villacoublay, France | $498,736 | 50% | 68% | 40% | A- | 1.5°C, SBTi |

| 12 | 42 | Xinyi Solar Holdings Ltd | Wuhu, China | $843 | 11% | 100% | 100% | A- | |

| 13 | 7 | Ørsted A/S | Fredericia, Denmark | $5,301 | 50% | 66% | 99% | A- | 1.5°C, SBTi |

| 14 | 11 | Sims Ltd | Mascot, Australia | $45,238 | 50% | 100% | 100% | A- | |

| 15 | 21 | Banco do Brasil SA | Brasília, Brazil | $623,504 | 38% | 24% | A- | 1.5°C, SBTi | |

| 16 | Rockwool A/S | Hedehusene, Denmark | $2,350 | 50% | 85% | 70% | A- | SBTi | |

| 17 | 12 | Johnson Controls International PLC | Cork, Ireland | $35,632 | 27% | 54% | 61% | A- | 1.5°C, SBTi |

| 18 | 2 | Chr Hansen Holding A/S | Hørsholm, Denmark | $43,041 | 50% | 20% | 97% | B+ | 1.5°C, SBTi |

| 19 | Kone Oyj | Espoo, Finland | $734,717 | 38% | 67% | 7% | B+ | SBTi | |

| 20 | 18 | Cascades Inc | Kingsey Falls, Canada | $4,198 | 50% | 92% | 80% | B+ | SBTi |

| 21 | 8 | Atlantica Sustainable Infrastructure PLC | Brentford, U.K. | $596 | 25% | 84% | 91% | B+ | SBTi |

| 22 | 14 | McCormick & Company Inc | Hunt Valley, U.S. | $65,393 | 36% | 49% | 7% | B+ | 1.5°C, SBTi |

| 23 | 35 | Novozymes A/S | Bagsvaerd, Denmark | $8,853 | 27% | 53% | 11% | B+ | 1.5°C, SBTi |

| 24 | 25 | Iberdrola SA | Bilbao, Spain | $3,712 | 43% | 72% | 85% | B+ | 1.5°C, SBTi |

| 25 | 84 | BT Group PLC | London, U.K. | $41,583 | 42% | 57% | 38% | B+ | 1.5°C, SBTi |

| 26 | 36 | Alphabet Inc | Mountain View, U.S. | $38,910 | 27% | 89% | 6% | B+ | SBTi |

| 27 | 45 | Vitasoy International Holdings Ltd | Hong Kong, China | $8,863 | 18% | 91% | 100% | B+ | |

| 28 | 5 | City Developments Ltd | Singapore, Singapore | $19,968 | 22% | 73% | 76% | B+ | 1.5°C, SBTi |

| 29 | 24 | Neste Oyj | Espoo, Finland | $9,381 | 33% | 39% | 71% | B+ | |

| 30 | 33 | Ecolab Inc | Saint Paul, U.S. | $30,832 | 42% | 71% | 53% | B+ | 1.5°C, SBTi |

| 31 | 12 | Kering SA | Paris, France | $978,971 | 57% | 39% | 25% | B | 1.5°C, SBTi, FCCA |

| 32 | 20 | Beijing Enterprises Water Group Ltd | Hong Kong, China | $4,526 | 7% | 74% | 100% | B | |

| 33 | ASM International NV | Almere, Netherlands | $98,187 | 33% | 98% | 63% | B | 1.5°C, SBTi | |

| 34 | 72 | StarHub Ltd | Singapore, Singapore | $41,945 | 23% | 47% | 0% | B | |

| 35 | 39 | SunPower Corp | Richmond, U.S. | 22% | 100% | 100% | B | SBTi | |

| 36 | 26 | Xerox Holdings Corp | Norwalk, U.S. | $51,747 | 25% | 75% | 3% | B | 1.5°C, SBTi |

| 37 | 49 | Telus Corp | Vancouver, Canada | $54,239 | 40% | 62% | 12% | B | 1.5°C, SBTi |

| 38 | 78 | Unilever PLC | London, U.K. | $107,250 | 42% | 30% | 6% | B | 1.5°C, SBTi |

| 39 | 50 | HP Inc | Palo Alto, U.S. | $398,038 | 46% | 61% | 29% | B | 1.5°C, SBTi |

| 40 | VMware Inc | Palo Alto, U.S. | $184,723 | 30% | 75% | 0% | B | SBTi | |

| 41 | 55 | SAP SE | Walldorf, Germany | $194,558 | 50% | 25% | 0% | B | 1.5°C, SBTi |

| 42 | BCE Inc | Verdun, Canada | $68,365 | 38% | 48% | 96% | B | 1.5°C, SBTi | |

| 43 | 83 | Coloplast A/S | Humlebaek, Denmark | $55,646 | 33% | 46% | 3% | B | 1.5°C, SBTi |

| 44 | 13 | Koninklijke KPN NV | Rotterdam, Netherlands | $38,857 | 43% | 55% | 100% | B | 1.5°C, SBTi |

| 45 | 81 | Cogeco Communications Inc | Montreal, Canada | $95,151 | 56% | 47% | 39% | B | 1.5°C, SBTi |

| 46 | First Solar Inc | Tempe, U.S. | $5,218 | 33% | 100% | 100% | B- | 1.5°C, SBTi | |

| 47 | 77 | Puma SE | Herzogenaurach, Germany | $270,328 | 33% | 29% | 0% | B- | SBTi, FCCA |

| 48 | 28 | Cisco Systems Inc | San Jose, U.S. | $82,189 | 36% | 58% | 0% | B- | 1.5°C, SBTi |

| 49 | 51 | Atea ASA | Oslo, Norway | $652,546 | 38% | 67% | 3% | B- | SBTi |

| 50 | 53 | Konica Minolta Inc | Chiyoda-ku, Japan | $28,739 | 11% | 52% | 1% | B- | SBTi |

| 51 | Giant Manufacturing Co Ltd | Taichung, Taiwan | 9% | 100% | 100% | B- | |||

| 52 | Essity AB | Stockholm, Sweden | $5,115 | 42% | 48% | 39% | B- | 1.5°C, SBTi | |

| 53 | 32 | Eisai Co Ltd | Bunkyo-ku, Japan | $103,312 | 9% | 33% | 24% | B- | 1.5°C, SBTi |

| 54 | ERG SpA | Genoa, Italy | $1,941 | 42% | 64% | 96% | B- | 1.5°C, SBTi | |

| 55 | 43 | Sprouts Farmers Market Inc | Phoenix, U.S. | 25% | 28% | 14% | B- | SBTi | |

| 56 | 75 | CapitaLand Investment Ltd | Singapore, Singapore | $10,348 | 27% | 38% | 41% | B- | SBTi |

| 57 | Sino Land Co Ltd | Hong Kong, China | $13,753 | 0% | 49% | 1% | B- | 1.5°C, SBTi | |

| 58 | Severn Trent PLC | Coventry, U.K. | $5,357 | 56% | 39% | 72% | B- | 1.5°C, SBTi | |

| 59 | 90 | Intesa Sanpaolo SpA | Turin, Italy | $375,162 | 37% | 12% | B- | 1.5°C, SBTi, NZBA | |

| 60 | 79 | Gildan Activewear Inc | Montreal, Canada | $7,843 | 30% | 39% | 1% | B- | SBTi |

| 61 | 67 | Sanofi SA | Paris, France | $86,211 | 38% | 20% | 13% | B- | 1.5°C, SBTi |

| 62 | Swatch Group AG | Biel, Switzerland | $66,638 | 33% | 50% | 49% | B- | ||

| 63 | 46 | Samsung SDI Co Ltd | Yongin, South Korea | $10,422 | 14% | 81% | 57% | C+ | |

| 64 | Yadea Group Holdings Ltd | Wuxi, China | $282,774 | 13% | 100% | 100% | C+ | ||

| 65 | 95 | Telefonaktiebolaget LM Ericsson | Stockholm, Sweden | $151,002 | 23% | 34% | 100% | C+ | 1.5°C, SBTi |

| 66 | 82 | Adidas AG | Herzogenaurach, Germany | $257,999 | 38% | 35% | 0% | C+ | SBTi, FCCA |

| 67 | 54 | Hewlett Packard Enterprise Co | Spring, U.S. | $170,695 | 36% | 50% | 20% | C+ | 1.5°C, SBTi |

| 68 | KB Financial Group Inc | Seoul, South Korea | $132,305 | 22% | 5% | C+ | SBTi, NZBA | ||

| 69 | Maxeon Solar Technologies Ltd | Singapore, Singapore | $5,227 | 11% | 100% | 100% | C+ | ||

| 70 | Orkla ASA | Oslo, Norway | $42,247 | 36% | 22% | 0% | C+ | 1.5°C, SBTi | |

| 71 | 76 | BNP Paribas SA | Paris, France | $267,081 | 47% | 21% | C+ | SBTi, NZAM, NZAO, NZBA | |

| 72 | Svenska Handelsbanken AB | Stockholm, Sweden | $1,448,025 | 54% | 2% | C+ | NZBA, SBTi | ||

| 73 | 48 | Apple Inc | Cupertino, U.S. | $6,309,148 | 33% | 71% | 0% | C+ | 1.5°C, SBTi |

| 74 | 69 | Kesko Oyj | Helsinki, Finland | $174,412 | 29% | 3% | 11% | C+ | 1.5°C, SBTi |

| 75 | 62 | Quadient SA | Bagneux, France | $156,273 | 33% | 23% | 0% | C+ | |

| 76 | Investec Ltd | Sandton, South Africa | $125,606 | 36% | 5% | C+ | NZBA | ||

| 77 | 55 | Sun Life Financial Inc | Toronto, Canada | $622,072 | 56% | 4% | C+ | NZAM | |

| 78 | 74 | Teck Resources Ltd | Vancouver, Canada | $3,689 | 29% | 7% | 23% | C+ | |

| 79 | NIO Inc | Shanghai, China | $160,817 | 17% | 96% | 100% | C+ | ||

| 80 | Ricoh Co Ltd | Ota-ku, Japan | $70,664 | 10% | 21% | 42% | C+ | 1.5°C, SBTi | |

| 81 | 63 | Henkel AG & Co KgaA | Düsseldorf, Germany | $61,401 | 44% | 20% | 1% | C+ | 1.5°C, SBTi, NZAM |

| 82 | 55 | Storebrand ASA | Lysaker, Norway | $89,785,901 | 50% | 5% | C+ | 1.5°C, SBTi, NZAM, NZAO | |

| 83 | Gilead Sciences Inc | Foster City, U.S. | 33% | 44% | 0% | C+ | SBTi | ||

| 84 | 22 | Sekisui Chemical Co Ltd | Osaka, Japan | $16,577 | 24% | 10% | 41% | C+ | 1.5°C, SBTi |

| 85 | 60 | Commerzbank AG | Frankfurt, Germany | $353,063 | 45% | 6% | C+ | SBTi, NZAM, NZBA | |

| 86 | 52 | Tesla Inc | Austin, U.S. | $91,536 | 25% | 100% | 100% | C | 1.5°C, SBTi |

| 87 | Beazley PLC | London, U.K. | $3,601,492 | 45% | 14% | C | NZIA | ||

| 88 | 80 | Bank of Montreal | Toronto, Canada | $224,613 | 50% | 4% | C | NZAM, NZAO | |

| 89 | 57 | Arçelik AS | Istanbul, Turkey | $226,657 | 17% | 5% | 3% | C | 1.5°C, SBTi |

| 90 | 98 | Canadian Tire Corporation Ltd | Toronto, Canada | $169,655 | 19% | 2% | 1% | C | |

| 91 | 71 | National Australia Bank Ltd | Melbourne, Australia | $130,528 | 33% | 5% | C | NZBA | |

| 92 | 41 | IGM Financial Inc | Winnipeg, Canada | $68,785,497 | 33% | 7% | C | ||

| 93 | Pfizer Inc | New York City, U.S. | $69,800 | 33% | 17% | 0% | C | 1.5°C, SBTi | |

| 94 | 70 | Nordea Bank Abp | Helsinki, Finland | $3,537,626 | 40% | 3% | C | NZAM, NZAO, NZBA | |

| 95 | Merck KGaA | Darmstadt, Germany | 43% | 32% | 20% | C- | SBTi | ||

| 96 | Société Générale SA | Paris, France | $276,944 | 40% | 3% | C- | NZBA, SBTi | ||

| 97 | 91 | AstraZeneca PLC | Cambridge, U.K. | $140,130 | 38% | 8% | 0% | C- | 1.5°C, SBTi |

| 98 | 56 | Koninklijke Philips NV | Eindhoven, Netherlands | $122,236 | 40% | 16% | 0% | C- | SBTi |

| 99 | Danaher Corp | Washington, D.C., U.S. | $79,075 | 29% | 16% | 0% | D+ | ||

| 100 | Novavax Inc | Gaithersburg, U.S. | 29% | 12% | 87% | D+ |

*Indicates a tie as a result of a data correction

Sustainable revenue now makes up half of gross revenue for the Global 100 compared to just 5% for the wider benchmark, while sustainable investment shows a similar trend. For every tonne of carbon they produce, Global 100 companies earn 33 times more revenue than ACWI firms.

But while improved productivity scores for carbon, energy, water and other environmental performance indicators are often collateral benefits of underlying megatrends, such as increasing electrification, energy efficiency and digitization, the improvement in sustainable revenues and investments is generally the result of much more deliberate corporate investment policies and strategic decisions, Torrie says. “Very often, there is visionary leadership from the CEO, and the company has a clear view of the way the world is headed and how to get ahead of it.”

That doesn’t mean that corporate sustainability leaders don’t have their challenges, though. In the face of Europe’s energy crisis, the Danish government ordered 2020’s top G100 company, wind giant Ørsted, to postpone the shutdown of three of its power station units that use oil and coal as fuel. “We still believe that we, as a society, must phase out the use of gas, oil, and coal as soon as possible, but we’re in the middle of a European energy crisis, and we will, of course, contribute to ensuring the electricity supply to the best of our ability,” Ørsted said in a statement.

All the while, companies outside the Global 100 are starting to catch up. While the average gender diversity of Global 100 boards inched upward slightly to 34%, that figure shot up from 23% to 32% for the broader universe of more than 6,000 companies analyzed for the Global 100. In racial diversity, there has been little improvement on company boards of directors, but there was a slight improvement in executive teams. The Global 100 and ACWI firms are neck and neck on the ratio of taxes paid, and ACWI firms have a slightly smaller gap between CEO to average worker pay.

A fifth of Global 100 companies are U.S.-based, making it the leading country for members of the index, followed by Canada with 11%. However, as a region, Europe still leads the way with 44%, while Asia Pacific hosts 22% of the ranking’s companies.

The leading sectors remain information technology (20%) and financial services (15%). Among the standout results of the rankings, Italian bank Intesa Sanpaolo saw a huge 234% increase in its sustainable revenue ratio thanks to a combination of increased exposure to sustainable social and environmental loans and better disclosure.

In the wake of the COVID-19 pandemic, new entrants to the index included a number of pharmaceuticals groups, such as Merck, Pfizer, Novavax and Gilead Sciences. Chinese electric vehicle maker NIO and its compatriot Yadea, which produces electric bicycles, were also notable entrants, along with two companies from Taiwan: bicycle maker Giant and the Taiwan High Speed Rail Corp. Torrie says the addition of these corporations reflects the improved reporting on environmental, social and governance (ESG) factors from companies in the region.

CLIMATE |

1.5˚C Business Ambition for 1.5˚C |

SBTi Science Based Targets Initiative |

FCCA Fashion Charter for Climate Action |

NZAM Net-Zero Asset Managers Initiative |

NZAO Net-Zero Asset Owners Alliance |

NZBA Net-Zero Banking Alliance |

|---|

Get the complete Excel scorecard for the Global 100 most sustainable companies of 2023

Corporate Knights’ 2023 ranking of the world’s 100 most sustainable corporations is based on a rigorous assessment of more than 6,000 public companies with revenue over US$1 billion. All companies are scored on applicable metrics relative to their peers, with 50% of the weight assigned to sustainable revenue and sustainable investment. Nine of the indicators have fixed weights; the rest are assigned weights according to each industry’s relative impact in relation to the overall economy. After quantitatively analyzing data for 25 key performance indicators, using the Corporate Knights methodology, this year’s overall scores were converted to letter grades.

Awarded to the top company

Above 75%

70% - 75%

65% - 70%

60% - 65%

55% - 60%

50% - 55%

45% - 50%

40% - 45%

35% - 40%

30% - 35%

25% - 30%

Get the latest sustainable economy news delivered to your inbox.