Around the world, sustainability-themed index funds are gaining traction and investors’ confidence. Over the past year, green funds experienced choppy flows but overall growth thanks to rising demand for advanced energy and China’s successes in expanding new markets for its low-emission technology. China is by far the world’s biggest clean-energy investor, spending US$625 billion in 2024 alone (while also being, contradictorily, the largest developer of coal power).

Green mutual funds and exchange-traded funds, or ETFs, have proven they’re better at withstanding shocks in our era of economic uncertainty, and investors have taken notice. A January 2025 study by researchers at Universidad de Medellín found that green ETFs are especially attractive to institutional and long-term investors because they “demonstrate resilience and potential for outperformance during market downturns.”

Dare Ogunbona, chief executive officer at Green Advisors Limited, attributes this out-performance over the past year to investors’ keen interest in “future-facing” sectors such as cleantech, electrification and battery supply chains. These industries have demonstrated clearer project pipelines, more corporate capital expenditure and better economics along supply chains. The green stocks that did better are “mostly utility‑scale solar, wind and storage leaders with solid power purchase agreements, dividend growth and policy tailwinds,” he says.

Better disclosure and strategy drive stronger index positioning, which draws capital, lowers funding costs and boosts valuation.

– Ray Tayyabi, vice president for ESG research, MSCI

The going has been so good that, in November, analysts at Jefferies Financial Group declared these the “glory days” for green investors. Aniket Shah, the firm’s global head of sustainability and transition strategy, told Bloomberg that investors have been too distracted by Trump’s anti-green rhetoric in the United States to recognize the “wonderful moment” that the green economy is enjoying around the world.

Sustainability attracts capital

In our annual Responsible Funds ranking, Corporate Knights identifies the 10 top-scoring funds across four equity categories: Canadian, global, international and U.S. The sustainability rating is based on the methodology deployed in the Global 100 most sustainable corporations in the world ranking, which prioritizes several key metrics: sustainable revenue, sustainable investment and sustainable revenue growth, as well as mechanisms that link senior executive pay to sustainability targets.

Green index funds are a major market category for passive investors. For example, about US$17 trillion in assets are benchmarked to MSCI indexes, of which $1.13 trillion tracks sustainability and climate benchmarks. “That’s about the same as infrastructure as an asset class globally,” says Rameez Ray Tayyabi, an executive director at MSCI.

Green index funds are a major market category for passive investors. For example, about US$17 trillion in assets are benchmarked to MSCI indexes, of which $1.13 trillion tracks sustainability and climate benchmarks. “That’s about the same as infrastructure as an asset class globally,” says Rameez Ray Tayyabi, an executive director at MSCI.

Sustainability and climate indexes have grown at 20% compound annual growth rate over the past three years, according to Tayyabi, and climate-indexed indexes have been the main driver of that growth. Investors are no longer focused on screening things out but on who is better- or worse-positioned for the energy transition, he says.

Firms with lower exposure to business risks from the energy transition appear in more green-themed funds and are weighted higher, which in turn leads to new passive inflows, Tayyabi explains: “Better disclosure and strategy drive stronger index positioning, which draws capital, lowers funding costs and boosts valuation.”

The dominance of decarbonization

Although U.S. President Donald Trump has cancelled more than $7.5 billion in grants for clean-energy projects and threatened another $12 billion, investments in clean energy continue to attract funds, especially with AI-driven demand for electricity and lower prices for renewables.

Even in the United States, Trump’s policy shift did not affect the demand for renewable energy, which is driven by market fundamentals: energy from renewables frequently costs less and is more stable than energy from fossil sources; states and cities are driving demand; and most corporate power purchasers, who signed record volumes of long-term clean power contracts in 2024, are still striving to meet climate targets.

Major investing firms are reading the writing on the wall and flocking to renewables. In February, for example, asset manager TPG acquired the U.S. solar developer Altus Power for $2.2 billion. In October, Ares Management bought a 49% stake in a diversified portfolio of renewable-energy assets in the United States operated by EDP Renováveis, in a deal that valued the total portfolio at $2.9 billion.

In a further indication of the dominance of decarbonization across portfolios, Brookfield announced in October that it had raised a record US$20 billion for its Global Transition Fund II, considered the largest private energy-transition fund in the world. Backed by an additional $3.5 billion in co-investments, the fund has effectively $23.5 billion to put to work and has already deployed $5 billion in the U.S. renewable developer Geronimo Power, France-based energy and storage developer Neoen, and Indian group Evren, which builds wind, solar and storage projects.

The global outlook for clean energy

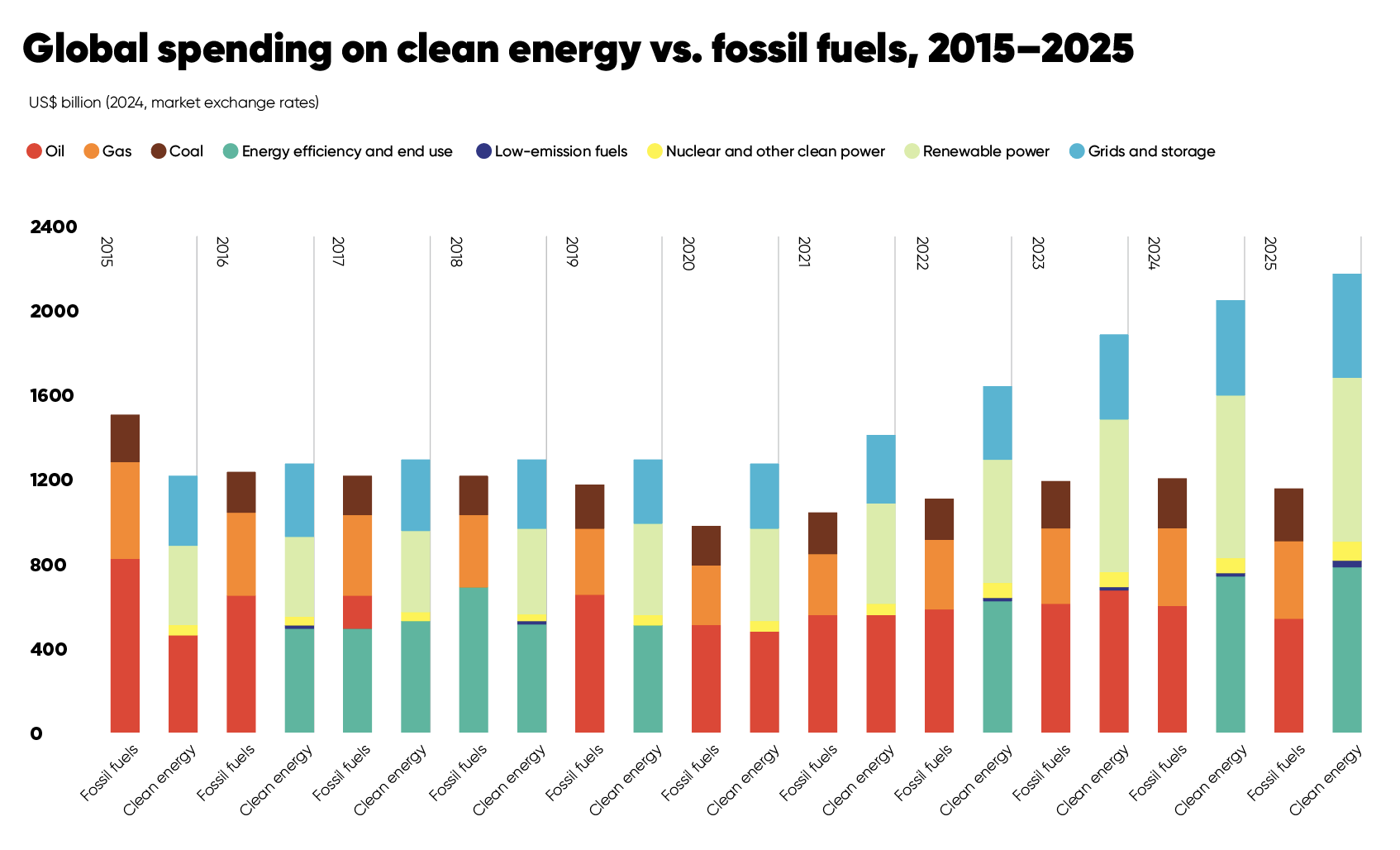

“Clean energy has had a good year after a very dismal past five years,” Tim Nash, the founder of Good Investing, says in an email. But while energy demand has increased this past year, Nash says, he points out that declining interest rates have played a key role in the growth of investments. Globally, investment in clean energy for 2025 is about US$2.2 trillion, according to the International Energy Agency’s World Energy Investment 2025, the 10th edition of the report.

This rebound has shown that green ETFs have the potential for continued growth, but Nash points out that not just green ETFs have performed well this year: “The entire market has had a great year,” he says. “[And] not all green stocks have outperformed.”

This rebound has shown that green ETFs have the potential for continued growth, but Nash points out that not just green ETFs have performed well this year: “The entire market has had a great year,” he says. “[And] not all green stocks have outperformed.”

However, Nash notes that market trends change quickly and so investors should not bother making predictions. The best approach, he says, is for investors to have a good plan and work with a financial planner to develop a suitable diversified portfolio that aligns with their values. “When markets go up we stick to the plan, and when markets go down we stick to the plan,” he says.

The factors driving the health of cleantech and green funds are expected to continue. Even if the unbridled growth of AI turns out to be a bubble, the broader electrification trend will continue to create demand for cost-competitive renewable energy, especially as big markets like Brazil and India double down on advanced power sources.

But investors need to also brace up because over the long term, Nash believes, they will see more government regulation on social and environmental issues as well as an increase in consumer demand for socially and environmentally responsible products – both factors that have the potential to influence the sector.

For this, Nash says that investors interested in investing in renewable energy need “to be intentional,” especially considering that “it is a more volatile sector than the rest of the market.”

Saint Ekpali is a Nigeria-based journalist who covers the environment, health and energy in Africa.

The Corporate Knights 2026 Responsible Funds ranking

| Rank | Fund name | % market weight covered* | Weighted rating** | Final score | Holdings date |

|---|---|---|---|---|---|

| CANADIAN EQUITY (149 eligible funds) | |||||

| 1 | Desjardins Sustainable Canadian Equity Income Fd I | 95.8% | 22.0% | 99.3% | 9/30/2025 |

| 2 | Mackenzie Betterworld Canadian Equity Fd Ser A | 94.6% | 20.1% | 96.6% | 3/31/2025 |

| 3 | Invesco S&P/TSX Composite ESG Index ETF (ESGC) | 99.1% | 20.1% | 95.9% | 9/30/2025 |

| 4 | RBC Vision QUBE FFF LV Canadian Equ Fd A | 98.1% | 19.3% | 93.9% | 6/30/2025 |

| 5 | CIBC Sustainable Canadian Equity Fund Series A | 97% | 19% | 93.2% | 6/30/2025 |

| 6 | Desjardins Sustainable Canadian Equity Fund A | 97.7% | 18.9% | 92.5% | 9/30/2025 |

| 7 | Invesco S&P/TSX Composite ESG Tilt Idx ETF (ICTE) | 99.3% | 18.9% | 91.8% | 9/30/2025 |

| 8 | Invesco S&P/TSX 60 ESG Tilt Index ETF (IXTE) | 99.3% | 17.9% | 89.1% | 9/30/2025 |

| 9 | iShares Jantzi Social Index ETF (XEN) | 100% | 16.1% | 84.4% | 9/30/2025 |

| 10 | NBI Sustainable Canadian Equity ETF (NSCE) | 97.8% | 15.5% | 82.4% | 9/30/2025 |

| GLOBAL EQUITY (226 eligible funds) | |||||

| 1 | Mackenzie Corporate Knights Glo 100 Ind ETF (MCKG) | 98.7% | 60% | 100% | 3/31/2025 |

| 2 | CI Global Climate Leaders Fund Series A | 93.6% | 34.1% | 98.6% | 3/31/2025 |

| 3 | CI MSCI World ESG Impact Index ETF (CESG) | 100% | 32.7% | 98.2% | 9/30/2025 |

| 4 | BMO Global Climate Transition Fund Series A | 93.6% | 25.9% | 97.7% | 3/31/2025 |

| 5 | AGF Global Sustainable Growth Equity Fund/ETF (AGSG) | 95.9% | 25.8% | 97.3% | 3/31/2025 |

| 6 | NBI Global Climate Ambition Fund Advisor Series | 97.2% | 22% | 96.4% | 9/30/2025 |

| 7 | Franklin Unconstrained Global Equity Fund A Hdg | 92.4% | 21.5% | 96% | 8/31/2025 |

| 8 | BMO MSCI ACWI Paris Aligned Clim Eq Idx ETF (ZGRN) | 99.5% | 21.2% | 95.5% | 9/30/2025 |

| 9 | Mackenzie Global Women's Leadership ETF (MWMN) | 100% | 20.7% | 94.2% | 7/31/2025 |

| 10 | VPI Sustainability Leaders Pool Series A | 96.2% | 20.1% | 93.3% | 9/30/2025 |

| INTERNATIONAL EQUITY (142 eligible funds) | |||||

| 1 | Franklin ClearBridge Intl Gth Fd Ser A | 96.2% | 19.2% | 99.2% | 8/31/2025 |

| 2 | NEI International Equity RS Fund Series A | 95.7% | 18.4% | 97.1% | 8/31/2025 |

| 3 | BMO MSCI EAFE Selection Equity Index ETF (ESGE) | 98.5% | 15% | 83.6% | 9/30/2025 |

| 4 | Invesco S&P Intl Developed ESG Tilt Idx ETF (IITE) | 98.9% | 14.7% | 82.2% | 9/30/2025 |

| 5 | DesjardinsRIDvex-USAex-CdM-F-Net-ZEmmPthwETF(DRFD) | 99.5% | 14.2% | 78.7% | 9/30/2025 |

| 6 | Wealthsimple Dev Mkts ex NA Soc Rsp Ind ETF (WSRD) | 98.5% | 13.7% | 75.1% | 9/30/2025 |

| 7 | Desjardins RIDev ex-USAexCdaNet-ZEmsPthwETF(DRMD) | 98.6% | 13.7% | 74.4% | 9/30/2025 |

| 8 | Invesco S&P Intl Developed ESG Index ETF (IICE) | 99% | 13.6% | 73% | 9/30/2025 |

| 9 | iShares ESG Aware MSCI EAFE Index ETF (XSEA) | 99.3% | 13.6% | 72.3% | 9/30/2025 |

| 10 | iShares ESG Advanced MSCI EAFE Index ETF (XDSR) | 99.6% | 12.7% | 63.1% | 9/30/2025 |

| U.S. EQUITY (206 eligible funds) | |||||

| 1 | BMO MSCI USA Selection Equity Index ETF (ESGY) | 100% | 21.2% | 98.5% | 9/30/2025 |

| 2 | Invesco ESG NASDAQ 100 Index ETF (QQCE) | 99.8% | 21.2% | 98% | 9/30/2025 |

| 3 | Invesco S&P 500 ESG Tilt Index ETF (ISTE) | 100% | 19% | 89.7% | 9/30/2025 |

| 4 | iShares ESG Advanced MSCI USA Index ETF (XUSR) | 99.7% | 18.5% | 88.2% | 9/30/2025 |

| 5 | Invesco S&P US Total Mkt ESG Tilt Idx ETF (IUTE) | 99.4% | 17.3% | 84.8% | 9/30/2025 |

| 6 | iShares ESG Aware MSCI USA Index ETF (XSUS) | 99.9% | 17.2% | 83.9% | 9/30/2025 |

| 7 | Invesco S&P 500 ESG Index ETF (ESG) | 100% | 17.1% | 83.4% | 9/30/2025 |

| 8 | Desjardins Sustainable American Equity Fund/ETF (DSAE) | 98.4% | 17.1% | 82.4% | 9/30/2025 |

| 9 | Franklin Sustainable U.S. Core Equity Fund Ser O | 98.7% | 16.5% | 78.5% | 6/30/2025 |

| 10 | Franklin U.S. Opportunities Fund Series A | 96.8% | 16.5% | 78% | 8/31/2025 |

| *Sum of a given fund’s underlying constituents’ weights that are rated by Corporate Knights. | |||||

| **The weight of a constituent of a given fund multiplied by its rating by Corporate Knights, summed up for all of that fund’s underlying constituents. | |||||

| ***The score of a given fund (based on the percent-ranking calculation approach) derived by comparing its weighted rating against that of other funds in the same category. | |||||

The Weekly Roundup

Get all our stories in one place, every Wednesday at noon EST.