ESG and AI. These ubiquitous acronyms are garnering significant media attention, and with good reason. According to the latest Future of Jobs Report, by the World Economic Forum, 85% of companies surveyed said AI would be the motor behind transformation in their organizations. They also reported that the adoption of environmental, social and governance (ESG) standards would affect who they hire, and how they work.

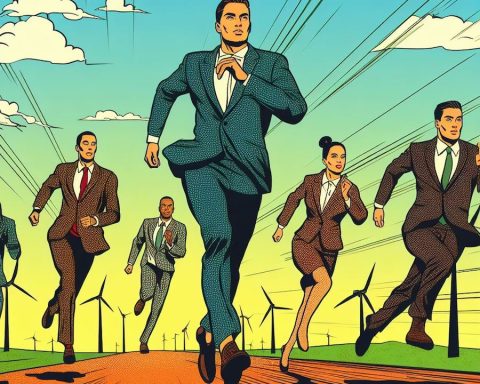

With the surge in demand for sustainability expertise and a growing number of AI-backed technologies, a vital question emerges: how will AI affect and transform roles in a discipline that continues to grow and evolve in response to socio-economic, cultural and environmental changes?

The prevailing narrative of job losses resulting from AI reflects the general scarcity mindset we live in; however, if we choose to position AI as an opportunity to improve collaboration and co-evolution, countless possibilities come into view.

A horizon of opportunities

For ESG professionals, the fourth industrial revolution – as this era of rapid technological advancement is known – represents a new horizon of opportunities. AI will create roles that demand a blend of technical acumen and deep sustainability expertise, making way for hybrid ESG roles and specialized roles that didn’t exist a decade ago.

“AI in the context of ESG should be viewed as a powerful tool in the arsenal of sustainability professionals,” says Sharmila Singh of Green Lens Consulting.

This means that sustainability specialists will get much-needed respite from sifting through voluminous sustainability reports, navigating convoluted regulatory guidelines, and crafting multifaceted reports catering to diverse stakeholders. Salesforce, the U.S. software giant, has already announced it will be using AI to automate aspects of its Net Zero Cloud ESG reporting tool. By automating repetitive tasks, ESG as a discipline can move from a retrospective review and reporting on a standard set of key performance indicators to much more interesting work that includes integration of ESG data into business strategy, stakeholder relationships, future-forward actions and innovation.

In a notable collaboration between Microsoft and the biodiversity platform iNaturalist, ESG professionals showcased the transformative power of AI in transitioning from mere data collection to meaningful action. The iNaturalist platform, which enables users to map and share biodiversity observations, faced challenges in processing vast amounts of data. Partnering with Microsoft’s AI for Earth initiative, the iNaturalist team implemented machine-learning models for automated species identification. This not only expedited data verification but also provided immediate, actionable insights. Researchers and conservationists were empowered to quickly move from collecting observations to implementing data-driven conservation strategies, highlighting the potential of AI in bridging the gap between data accumulation and actionable ESG outcomes.

We are already seeing a clear shift from generic ESG positions that encompass a wide range of skills and competency to specialized expertise that enhances the capacity of ESG professionals to influence strategic decision-making.

Striking the right balance: Ensuring AI reliability in ESG

Adaptability, lifelong learning and a forward-thinking mindset will be the cornerstones of success in this evolving landscape.

Despite the evident benefits of AI, “reliability is a concern,” cautions Toby Sparwasser Soroka, business development lead at Brrink. The Berlin-based company creates AI infrastructure that can be integrated into ESG workflows to make data collection more efficient so essential insights can be generated faster. “AI hallucinations, which involve generating seemingly accurate yet contextually erroneous outputs, are a real possibility.”

Given the intricacies of ESG regulations and the consequences of misreporting, it’s paramount to ensure the accuracy of AI outputs. Privacy concerns, too, loom large. The technology’s vast data collection can include sensitive information, while its powerful inference abilities can predict private attributes or behaviours without relying on direct data. The governance category – or “G” in ESG – is a logical place for a company’s disclosure on AI policy and use.

And AI further bolsters the need for the ESG professional to move from data collector to critical reviewer of data and context, thereby providing a layer of human scrutiny.

“AI isn’t a substitute but an enabler, augmenting the productivity of the existing workforce,” Soroka says. “The human touch – a nuanced understanding, strategic mindset and engagement skills – remains irreplaceable.”

As AI manages the routine tasks, there will be a growing demand for professionals who can navigate the intricate juncture of AI and ESG – experts who can understand the AI outputs, validate them and integrate them seamlessly into broader ESG strategies. ESG professionals equipped with AI tools are better positioned to navigate the evolving sustainability landscape, ensuring transparency, compliance and positive impact.

“What AI promises is to elevate these strengths by fostering efficiency,” Soroka says.

A symbiotic relationship

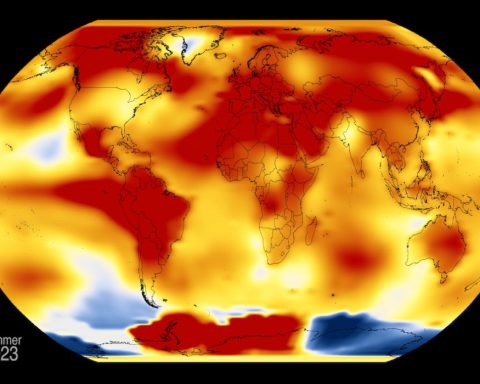

Singh highlights that “the symbiotic relationship between AI and ESG is the key to unlocking a sustainable future that balances profit with purpose.” She also raises the possibility of connecting AI to Indigenous knowledge in the context of sustainability. “How can we better connect AI to Indigenous knowledge to improve environmental management or address, avoid or minimize the impacts of changing climatic conditions, for example the wildfires in Hawaii?” she asks.

Moreover, with AI’s propensity to adapt and evolve, continuous learning becomes critical. ESG professionals must be equipped with not only deep sustainability knowledge but also a foundational understanding of AI mechanisms. This dual expertise will ensure that AI tools are used to their fullest potential while maintaining the sanctity of ESG metrics.

The job market will likely see a surge in positions focused on AI-ESG integration, AI ethics in ESG, and even roles dedicated to the continuous training and fine-tuning of these AI models, ensuring their outputs align with the rapidly evolving ESG standards.

The ESG landscape is on the brink of a transformative era. As AI becomes an integral tool in ESG reporting and management, the key lies in harmonizing the strengths of both. AI should not be viewed as a panacea but rather as an ally – one that can empower ESG professionals to craft a more sustainable and transparent corporate world.

Shilpa Tiwari is the founder and CEO of Isenzo Group, an ESG strategy and communications firm.