In early May, the federal government announced that Canada had “bent the curve” on climate pollution. New figures showed that carbon emissions in 2022 fell to “significantly lower” than pre-pandemic levels in 2019, giving hope that Canada can meet its net-zero commitments. “The hard work of Canadians is paying off,” Environment Minister Steven Guilbeault said.

That hard work is often hard to see, the product of millions of Canadians and thousands of businesses quietly, persistently adopting new approaches to life and work, eschewing waste, prioritizing collaboration and generally learning to do more with less. Since 2002, Corporate Knights has recognized this work by publishing the Best 50 list of Canada’s top corporate citizens – the businesses that prize sustainability as well as commerce.

Now in its 23rd year, the Best 50 helps track how Canadian businesses are meeting the low-carbon and green-transition challenge – as well as where they’re getting stuck in the process.

You already know many of these companies – you’ve ridden their buses (Société de transport de Montréal), pocketed their coins (Royal Canadian Mint), used their phone networks (BCE, Telus and Rogers), shopped there (Canadian Tire) or bought the T-shirt (Gildan Activewear). The companies that made the Best 50 are mostly corporations with more than $1 billion in annual revenues, as well as Crown corporations, large co-ops and members of the S&P/TSX Renewable Energy and Clean Technology Index. What sets them apart is their commitment to doing business differently – they’re companies that derive significant revenue from greener products and services, invest in increasingly sustainable projects, and prioritize equity in their operations.

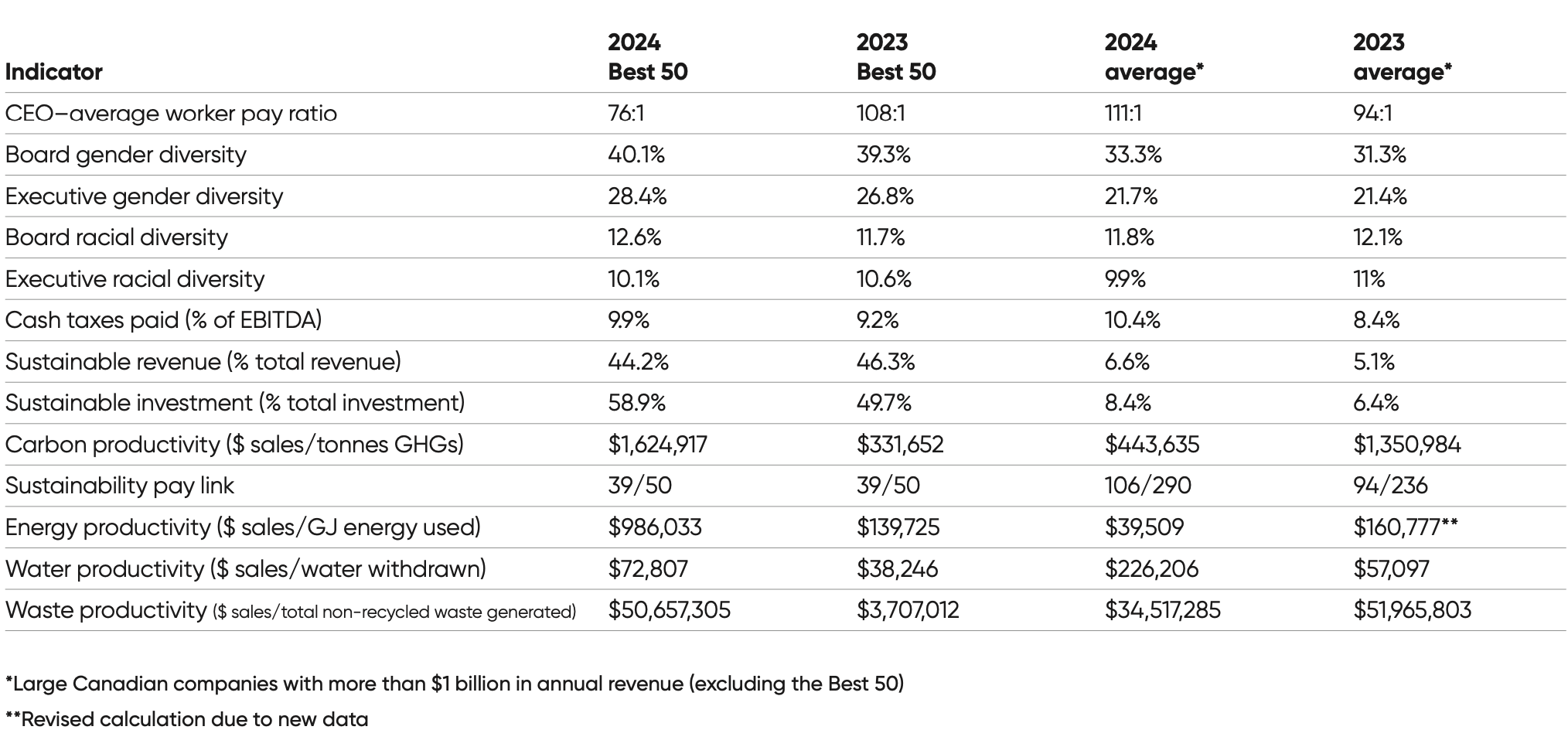

Crucially, the companies’ average sustainable investment (as a percentage of total investment) hit 58.9% this year, up 9% over last year’s 49.7% – that’s compared to just 8.4% for the average large Canadian corporation.

2024 Best 50 ranking table

| 2024 rank | 2023 rank | Company | Peer group (CKPG) | Overall grade | Climate commitments |

|---|---|---|---|---|---|

| 1 | 4 | Société de transport de Montréal | Transit & ground transportation | A+ | |

| 2 | 5 | Stantec Inc | Business, engineering & personal services | A- | 1.5°C, SBTi |

| 3 | 6* | Co-operators | Insurance companies | B+ | NZAM, NZAOA |

| 4 | 1 | Innergex Renewable Energy Inc | Power generation | B+ | |

| 5 | 6* | WSP Global Inc | Business, engineering & personal services | B+ | 1.5°C, SBTi |

| 6 | 25 | Royal Canadian Mint | Metal products manufacturing | B+ | SBTi, 1.5°C |

| 7 | 2 | Brookfield Renewable Partners LP | Power generation | B | SBTi |

| 8 | 16 | Alectra Inc | Power transmission & distribution | B | |

| 9 | Wheaton Precious Metals Corp | Asset management | B | SBTi | |

| 10 | 3 | Hydro-Québec | Power generation | B | |

| 11 | 19 | Toronto Hydro Corp | Power transmission & distribution | B | |

| 12 | 18 | Cascades Inc | Packaging | B | SBTi |

| 13 | 11 | Vancouver City Savings Credit Union | Banks | B | NZAM, NZBA |

| 14 | Export Development Canada (EDC) | Banks | B | ||

| 15 | 21 | Boralex Inc | Power generation | B- | SBTi, 1.5°C |

| 16 | 13 | Énergir | Natural gas transmission & distribution | B- | |

| 17 | 17 | Greenlane Renewables Inc | Power generation | B- | |

| 18 | Lion Electric Co | Cars & trucks manufacturing, including parts | B- | ||

| 19 | 20 | BCE Inc | Telecom providers | B- | SBTi, 1.5°C |

| 20 | 27 | Hydro One Ltd | Power transmission & distribution | B- | |

| 21 | 32 | Teck Resources Ltd | Metal & coal mining | B- | |

| 22 | 22 | Cogeco Communications Inc | Telecom providers | C+ | SBTi, 1.5°C |

| 23 | 10 | Telus Corp | Telecom providers | C+ | SBTi, 1.5°C |

| 24 | 9 | Northland Power Inc | Power generation | C+ | |

| 25 | 7 | Canadian National Railway Co | Freight transport, all modes | C+ | SBTi, 1.5°C |

| 26 | 37 | Canada Post Corp | Freight transport, all modes | C+ | SBTi, 1.5°C |

| 27 | 49 | BGIS | Real estate & leasing | C+ | SBTi |

| 28 | 33* | Sun Life Financial Inc | Insurance companies | C+ | NZAM |

| 29 | 31* | Desjardins Group | Banks | C | SBTi, 1.5°C, NZAM |

| 30 | Franco-Nevada Corp | Asset management | C | ||

| 31 | 15 | EPCOR Utilities | Power transmission & distribution | C | |

| 32 | 38* | Bank of Montreal | Banks | C | NZAM, NZBA |

| 33 | 14 | Saskatchewan Telecommunications Holding Corp | Telecom providers | C | |

| 34 | 28 | EcoSynthetix Inc | Basic inorganic chemicals & synthetics | C | |

| 35 | 33* | Kruger Products Inc | Forest products | C | |

| 36 | Polaris Renewable Energy Inc | Power generation | C | ||

| 37 | 8 | Canadian Pacific Kansas City Ltd | Freight transport, all modes | C | SBTi |

| 38 | 29 | Rogers Communications Inc | Telecom providers | C- | SBTi, 1.5°C |

| 39 | 39** | Manulife Financial Corp | Insurance companies | C- | SBTi, 1.5°C |

| 40 | 33* | IGM Financial Inc | Asset management | C- | NZAM |

| 41 | 23 | British Columbia Hydro and Power Authority | Power generation | C- | |

| 42 | 26 | Transcontinental Inc | Plastic & rubber product manufacturing | C- | SBTi |

| 43 | 24 | Gildan Activewear Inc | Textiles & clothing manufacturing | C- | SBTi |

| 44 | 36 | Manitoba Hydro-Electric Board | Power generation | D+ | |

| 45 | 30 | Celestica Inc | Semiconductor & electronic components manufacturing | D+ | SBTi |

| 46 | iA Financial Corp Inc | Asset management | D+ | ||

| 47 | 44 | Canadian Tire Corp Ltd | Retail, except grocery & auto | D+ | |

| 48 | 42 | Canadian Utilities Ltd | Power transmission & distribution | D+ | |

| 49 | 50 | Paper Excellence Canada Holdings Corp | Forest products | D+ | |

| 50 | 35 | GFL Environmental Inc | Waste management | D+ |

*Indicates a tie as a result of a formula correction

**Revised rank due to a formula correction

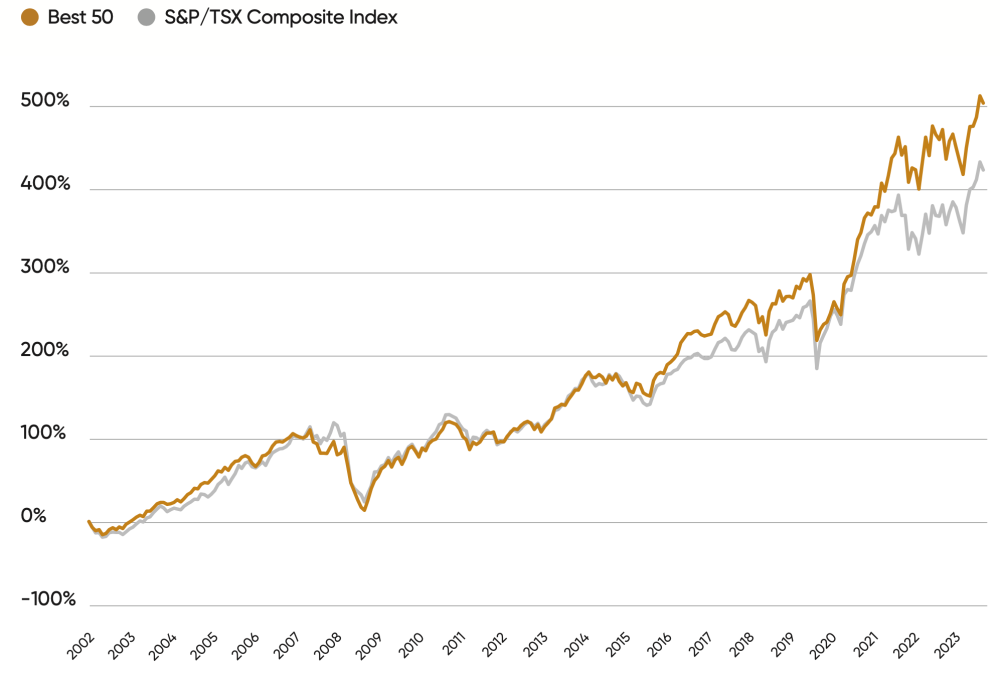

“How a company invests its capital expenditures today is a major determinant of how sustainable its revenue will be tomorrow. The fact that we’re seeing a significant jump in sustainable investments among Best 50 companies tells us that more corporate leaders see sustainability as a business imperative,” says Michael Yow, director of corporate rankings at Corporate Knights. There’s also evidence that companies can do better by doing good. Since the inception of this list on June 1, 2002, the stock prices of publicly listed companies on the Best 50 have outperformed the S&P/TSX Composite Index by 80% (as of April 30, 2024).

Driving into first place

In first place on the list this year is a different kind of public company: Société de transport de Montréal (STM) gets 85.4% of its revenues from delivering greener public transit. Better still, Corporate Knights researchers found that 82.3% of STM’s capital investments (up from 45.8% last year) now go toward building low-carbon infrastructure – including the expansion of its Metro line and a large underground garage to support subway service expansion.

Beyond cutting carbon, STM stands out for its commitment to equity and inclusion. In an era of runaway executive compensation, its CEO earns just 5.2 times more than the company’s average worker – well below the Best 50 average of 76 times. In addition, women make up half of the company’s board of directors, and STM has committed to “universal accessibility,” striving to minimize barriers to the use of transit for all its customers – even as it maintains a personalized para-transit service.

Second-place Stantec, which calls itself “a global leader in sustainable design and engineering,” is also committed to building sustainable cities. Ranked as the world’s ninth-most-sustainable company earlier this year on Corporate Knights’ Global 100 list, Edmonton-based Stantec has built its latest three-year strategic plan on “purpose-driven growth.” To Stantec, the climate crisis is one big opportunity; it’s focusing in particular on the energy transition, coastal resilience, ecosystem restoration, smart cities and international development.

The Best 50 includes many firms in industries central to the energy transition, such as power generation and transmission (which includes a whopping 14 companies, from giants such as Hydro-Québec and Ontario’s Hydro One to renewables specialists such as Innergex – last year’s top company – and Brookfield Renewable). But the list also identifies values-based companies in many other sectors, including manufacturing (six), communications (five), banks and insurance (four), and rail transportation, engineering services and forest products (two each). More evidence that any company, in any industry, can choose a more sustainable path.

The fact that we’re seeing a significant jump in sustainable investments among Best 50 companies tells us that more corporate leaders see sustainability as a business imperative.

–Michael Yow, director of corporate rankings, Corporate Knights

This year’s Best 50 list also demonstrates that the road to the future is not perfectly straight. For instance, CEOs are still pushing the limits on executive compensation. While the average ratio of CEO pay to average employee pay dropped this year to 76:1 from 108:1 among last year’s Best 50 cohort, that stemmed mainly from unusually large decreases at just two companies compared to 2023. Our researchers report that, of the companies appearing on both years’ lists, 21 firms green-lit increases in their CEO pay ratios, and just 13 managed decreases.

In another sign of fitful progress, executive gender diversity improved to just 28.4% this year, versus 26.8% last year. But while there are still more CEOs named Michael than there are female CEOs in Canada, 12% of Best 50 companies are led by women. Especially making their presence felt are Marie-Claude Léonard, a 20-year STM veteran who leads the top firm on the list; Tracy Robinson, appointed CEO of Canadian National Railway in 2022, who is the first Canadian woman to run a national railroad; Marie Lemay, who heads the most-improved organization, the Royal Canadian Mint; and Mairead Lavery, who runs Export Development Canada, the company with the lowest ratio of CEO pay to average worker pay.

Best 50 vs. the rest

How do Canada’s Best 50 Corporate Citizens stack up against other large Canadian companies?

Across Best 50 companies, board racial diversity inched up to just 12.6%, compared to last year’s 11.7%. Yes, change takes time, but companies dragging their heels on this do their shareholders a disservice; the research shows that organizations driven by diverse viewpoints and experiences are more resilient and successful than those dominated by monocultures.

While there are still more CEOs named Michael than there are female CEOs in Canada, 12% of Best 50 companies are led by women.

Five companies on this year’s list achieved a perfect score of 100% in terms of investing in sustainable assets and activities: Montreal-based Innergex Renewable Energy (which was our top company of 2023) and Kingsey Falls, Quebec–based Boralex, both of which produce green energy through wind, solar and hydroelectric projects in North America and Europe; Vancouver-based Greenlane Renewables, which makes systems that purify biogas to produce a cleaner, renewable fuel; Burlington, Ontario–based EcoSynthetix, which produces bio-based materials that replace fossil-based chemicals in everything from personal products to paperboard and packaging; and, new to the Best 50 this year, Saint-Jérome, Quebec–based Lion Electric.

Lion Electric was founded by two former employees of Corbeil, a bankrupt Quebec bus manufacturer. Their goal: to produce all-electric school buses. Today, Lion sells North America’s only all-electric school bus, and it’s ramping up production of medium- and heavy-duty electric trucks. But the just transition can be a hard road to travel. While Lion sold a record 852 vehicles last year, demand grew more slowly than expected – leading the company to a net loss of US$104 million.

No one can see the future, but forward-looking companies such as those on the Best 50 know that success most often comes from grappling with change – not avoiding it.

Rick Spence is a business journalist and senior editor at Corporate Knights.

Climate commitments legend

1.5°C: Business Ambition for 1.5C

SBTi: Science Based Targets initiative

FCCA: Fashion Charter for Climate Action

NZAM: Net-Zero Asset Managers Initiative

NZAO: Net-Zero Asset Owners Alliance

NZBA: Net-Zero Banking Alliance

Key performance metrics

All companies are scored on applicable metrics relative to their peers, with 50% of the weight assigned to sustainable revenue and sustain- able investment. Nine of the 25 indicators have fixed weights; the rest are assigned weights according to each industry’s relative impact in relation to the overall economy. After quantitatively analyzing data for 25 key performance indicators, using the Corporate Knights methodology, this year’s overall scores were converted to letter grades.

Sustainable revenue: % of total revenue derived from products and services categorized as “sustainable” under the Corporate Knights Sustainable Economy Taxonomy

Sustainable investment: % of total investments in assets categorized as “sustainable” under the Corporate Knights Sustainable Economy Taxonomy

Board/executive gender diversity: % of board directors/executive team who are gender diverse

Board/executive racial diversity: % of board directors/executive team who are racially diverse

Sustainability pay link: Link between senior executives’ variable compensation and sustainability-themed performance targets

Taxes paid: Based on company’s ratio of cash taxes paid to profit over past five years

Paid sick leave: 10 or more paid sick-leave days per year

Pension fund status: A series of calculations assessing the generosity/viability of defined contribution/defined benefit plans

Energy/carbon/water/waste productivity: $ revenue per unit (gigajoule/tonne/cubic metre/tonne) of non-renewable energy consumption, direct/indirect CO2e, water withdrawal, non-recycled waste produced

VOC/NOx/SOx/PM productivity: $ revenue per tonne of VOC, NOx, SOx and particulate matter emissions

CEO–average worker pay: How much more CEO gets paid (expressed as multiple com- pared to average worker)

Supplier score: The supplier with the highest score according to the CK scoring methodology among the company’s five largest suppliers

Financial sanctions: Total fines, penalties and settlements as % of revenue

Fatalities: Fatalities per total employee count

Injuries: Lost-time injuries per 200,000 work hours

Turnover: Number of departures divided by the average total employees

Political influence: Whether the company discloses how its own and its major trade/industry association’s policy engagements align with the Paris Agreement.