The chief executive of a large insurance company recently asked me what the best way would be to catalyze his sector to rise to the climate challenge (meaning align their insurance policies to support climate action as well as their general account investments).

Would it be to lead by example – show a measured and steady path to net-zero by 2050 with meaningful interim targets, something the rest of the industry could relate to – or a more radical all-in approach that might be difficult for other peers to identify with?

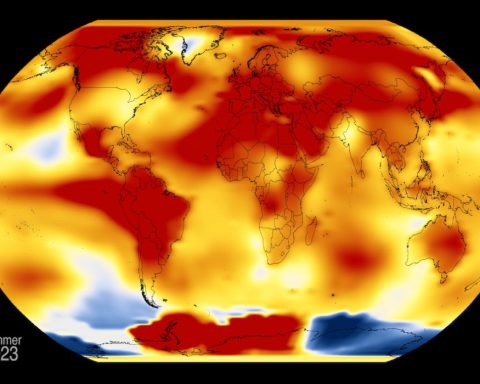

This slow and steady approach is the usual path taken by immense corporations, but with signs of climate breakdown in the acrid smoke-filled air, this path leads directly to the “gates of hell,” as the UN Secretary-General told world leaders in New York this September.

We have a need for speed on climate action.

This is about human and planetary needs, but heeding this call for climate action no longer requires corporations to renounce greed – which was always going to be a tough sell at scale.

The reason for this is the previous decade’s hyper-growth in clean technology is being driven by historic and in some cases unprecedented cost reductions. Whether we are talking electric cars, green power, energy storage, heat pumps or plant protein, the solutions to climate change are doubling every three to four years everywhere you look. According to the International Energy Agency (IEA), the world will add a record 440 gigawatts of new renewable capacity this year. That is more than double what we added in 2019, double what the IEA predicted in 2020.

When the world is changing this quickly, it is hard for the naked eye to pick it up. Imagine a pond that has lily pads covering 2% of it (roughly the percentage of cars on the road today that are electric). If the lily pads double every day, in seven days the entire pond is festooned with lily pads (note: as any rhizome specialist will know, lily pads take a little longer to multiply, about 15 years for one pad to cover 15 square feet).

We need more leaders to go all-in on climate action to clear the path so others can step up the pace. This means investing as much as possible as fast as possible to gear up your business to be at the heart of climate solutions.

Take Tesla as an example. The company went all-in on electric cars and became more valuable than most of the world’s carmakers combined before it had captured 1% of the market share. This happened because the company was surfing an exponential growth curve of decarbonization that now pervades every industry from power to food to buildings and industrials. Now the rest of the automakers, from Detroit to Wolfsburg, have been stirred from the internal combustion stupor and are hitting their electric stride so that Elon Musk does not eat their lunch.

We need more leaders to go all-in on climate action to clear the path so others can step up the pace. This means investing as much as possible as fast as possible to gear up your business to be at the heart of climate solutions.

At Corporate Knights, we have been keeping tabs on what 3,000 of the world’s largest companies are doing (and not doing) with their investments today, investments that define what kind of company they will be tomorrow.

Two staggering results pop out.

One: investments in climate solutions are in the trillion-dollar space and have doubled in just the past three years.

Two: the top fifth of companies are setting the pace. They account for the vast majority of this investment in solutions, and it turns out that, as a group and across most industries, their total share price performance has profoundly outperformed the market at large, earning triple the returns over the past three years.

The head of the IEA, Fatih Birol, recently said that “we are witnessing the beginning of the end of the fossil fuel era.” He said he was filled with hope by the exponential growth in climate solutions, which he described as “staggering” and “spectacular.”

“I feel more optimistic than I felt two years ago,” Birol said.

The name of the game on climate action is speed. We need to go faster and we can.

The good news, thanks to human ingenuity, is that it can be both profitable and popular.