It’s green as far as the eye can see in a bucolic field pierced by hydro towers that stretch up like metallic scarecrows. Amid tufts of wildflowers, there is the occasional wail of a train and the rumble of a highway. This quiet forest and wetlands on the banks of the Richelieu River outside of Montreal is in the midst of a dramatic transformation, buzzing with activity that may pave the way for our future.

At least, that is what leaders in Quebec are banking on, as the province gears up to assume an axis position in the world’s electrified transition. Quebec’s riches have long been on display. One of the mining capitals of the country, accounting for one-fifth of Canada’s mineral production, it has baked into its bedrock the precious elements coveted in the electric vehicle boom – graphite, nickel, copper, cobalt, platinum and the showstopper: lithium. And increasingly, the provincial and federal governments have been pouring money into the rest of the supply chain, with investments like the one slated for the green fields in Saint-Basile-le-Grand and McMasterville, a short drive from Montreal.

Here, Swedish climate-tech giant Northvolt has plans to build a “gigafactory” the size of 318 football fields that the federal government calls the cornerstone of a unique integrated battery production line in Canada. With more than $7 billion in investments and incentives, the first phase of the project at “Northvolt Six” will have an annual cell production capacity of 30 gigawatt hours and create up to 3,000 jobs in the region. They will be making what Ottawa has called “the world’s cleanest batteries,” at a rate of one million per year once the plant is fully operational.

But big questions loom over Quebec’s battery bet, amid an energy landscape that appears to be shifting by the day. A recalibration of the explosive growth projected for electric vehicles is forcing companies such as Northvolt to shrink their global operations, even as competition from neighbouring Ontario to attract EV business grows. While protectionist tariffs against more affordable Chinese-made EVs will affect how quickly Canadians make new mobility choices, the energy transition is nonetheless moving full steam ahead in Quebec, where EV adoption is among the highest in the country.

“Getting a car manufacturer in Quebec was not my objective,” says Pierre Fitzgibbon, Quebec’s former minister of economy and energy, in an August interview, expressing a divergent path from that of Ontario, which includes EV assembly.

Fitzgibbon, who resigned his post in September, travelled to Japan, South Korea and China in 2019 – when “the word ‘battery’ was not in Quebec’s vocabulary” – with a goal of understanding how the Asian powerhouses had secured a head start in the EV race. He came back focused on leaning into Quebec’s competitive advantage. “My objective was: how can we transform here in Quebec our critical minerals, as opposed to what had been happening before, which was to export it on a raw basis,” he says. “We’re setting up a kind of ecosystem.”

The provincial government touts itself as the first in the country to develop a critical minerals strategy, which it first released in 2020. At the moment, there are 25 mines in varying stages of economic evaluation or exploration to produce the minerals needed for energy transition. That’s on top of the one graphite mine, one lithium mine and two mines already extracting combinations of nickel, copper and cobalt. Quebec’s strategy is buttressed by circularity, mining the “urban mine” of used, recalled or damaged batteries that are piling up around us. In June, doors opened on the province’s first critical minerals extraction plant, by Lithion Technologies, located on the outskirts of Montreal and one of the first in North America. Once fully operational, the facility will have the capacity to shred 45,000 EV batteries per year.

RELATED:

Canadians want EVs they can afford – China has them. Let them in.

Six Nations leading the charge on Canada’s largest battery farm

Electrifying driving in Canada will cost just 10% more than what we already spend

Beyond the precious elements in its soil, Quebec’s ample hydro power – at what the minister calls a “very reasonable” price – offers companies the chance to build sustainability into their business models.

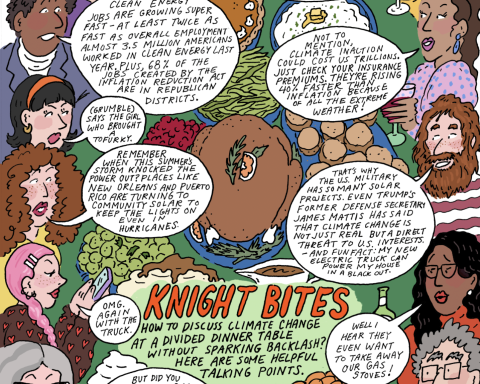

Of course, it’s not just about access to cheap green energy. In the race to secure a place in the EV transition, governments around the world have been pushed to provide hefty incentives to lure investment (or block competition, like the 100% tariffs on Chinese-made EVs by Canada and the U.S., and lower ones in Europe). Canada and Quebec have been matching the kind of production support available under the U.S.’s Inflation Reduction Act for the Northvolt battery line, topping out at $4.6 billion. In addition, Quebec has earmarked $3.46 billion in loans, subsidies and equity investment for 15 battery projects so far. Among the recipients of the funding is a cathode factory by General Motors and South Korea’s POSCO Chemical, in Bécancour, slated to be another battery hub, or “battery valley,” near Trois-Rivières. Construction on a third joint cathode venture, also in the Bécancour area but this time between Ford, Korea’s EcoPro BM and SK On, was recently put on hold.

Strategy speedbumps

For all its green transition promise, the efforts are not without controversy. Fitzgibbon’s resignation unleashed a wave of criticism over how the Coalition Avenir Québec government was handling energy policy, with Conservative Party of Quebec leader Éric Duhaime calling its strategy of focusing on electrification and battery production “a very risky bet, potentially even already a failure.”

The Northvolt project, due to its scope and degree of public investment, has garnered the most scrutiny thus far, especially from environmental groups and Indigenous communities that say the government has circumvented the rules and failed to properly consult and evaluate the project. Local residents have raised concerns about the potential environmental impacts, in particular on the Richelieu River, which is a source of drinking water for some 300,000 households and a biodiverse habitat with protected fish stocks. In more extreme examples of opposition, vandals have driven nails and metal bars into trees to prevent forests from being cut down and planted incendiary devices made of bottles filled with flammable liquid on the site. No one has been injured, but it’s put the community on edge and caught company and government officials off guard.

“It’s really a case about how the government and minister of the environment take decisions about big industrial projects,” says Marc Bishai, a lawyer with the Quebec Environmental Law Centre (Centre québécois du droit de l’environnement, or CQDE). The group has filed a lawsuit challenging the provincial government’s decision to make a change to its environmental assessment rules, thus exempting the first phase of the plant from a comprehensive impact assessment, known in Quebec as a BAPE. A court denied CQDE’s bid to halt the felling of thousands of trees on the 170-hectare site. “The government is denying the public the ability to participate in the decision, which normally happens in Quebec,” Bishai says.

The Mohawk Council of Kahnawake has also taken Quebec and Canada to court for allegedly breaching their duties to consult, both in terms of approval of the Northvolt project and, in the case of Quebec, over destruction of wetlands.

Fitzgibbon denies that the rules were changed for the Northvolt project, although in March, Environment Minister Benoit Charette told the media that an environmental assessment at that juncture would have delayed approval and jeopardized Quebec’s chances to secure the gigafactory. He insisted the company will nonetheless have to satisfy the province’s stringent environmental standards.

Navigating headwinds

On the streets of the picturesque village of Saint-Basile-le-Grand, community members raise concerns about potential environmental risks from the factory, while also expressing interest in the employment opportunities the complex would generate. Long-time residents such as Annie Chabot, a 57-year-old educator, say the issue has been divisive. Chabot wishes the government had undergone a more extensive environmental assessment. “But I’m not against the project,” she says.

Northvolt is facing other headwinds. With the projected growth of EVs slowing in the near term, driving companies such as Ford to reevaluate their plans, the company announced in July that it was undergoing a “strategic review,” prompting a flurry of media coverage speculating that Northvolt Six was in peril. The Swedish company has repeatedly stressed that it remains committed to Quebec, most recently in September, when it announced a slate of closures and mergers for several sites around the world, Northvolt Six not among them. Potential revisions to the timelines of the Quebec facility and others “will be confirmed during the fall, along with any further necessary cost-saving actions,” the company said in a statement.

As long as we still want to decarbonize the planet, this is a very sound strategy.

—Pierre Fitzgibbon, Quebec’s former minister of economy and energy

Fitzgibbon says delays are to be expected. The evolving technology may affect how quickly EVs are adopted but not if they are, he maintains. “As long as we still want to decarbonize the planet, this is a very sound strategy,” he says.

Quebec, which has a track record of leading environmental policy in Canada, has shown its commitment to the electric transition through consumer policy, too. Since 2012, Quebec has offered a healthy rebate for the purchase or lease of an EV. And it has paid off. Quebecers are buying far more EVs than the rest of the country. Electric vehicles had a 21.5% chunk of the vehicle market in the province in the second quarter of this year (compared to 9.9% in Canada overall and 8% in the U.S.). In announcing its decision to phase out the financial incentive for EVs by 2027, the Quebec government said the industry no longer needs that extra help.

For Normand Mousseau, director of the Trottier Energy Institute at Polytechnique Montréal and a co-chair of the Quebec Commission on Energy Issues in 2013, the success of Quebec’s battery bet is far from clear. He says that there is no obligation for manufacturers such as Northvolt to source their critical minerals from Quebec, so the fully integrated supply chain may not be realized. And he thinks the province missed a critical opportunity to link the energy transition to intellectual property.

“There was no demand from these industries to invest in any research and development in Quebec. And it’s the same in Ontario,” he says, referring to large government subsidies for EV and battery plants. “We’ve seen it with Hyundai and GM. They set up shop here, and after a few years they leave, because there is nothing that ties them in terms of higher value.”

Still, he acknowledges that time is of the essence as the world races to decarbonize, and “you can sit on the side and wait until you have a perfect investment, or you take bets.”

While some supply chain investments may look shaky, others, such as the Lithion Technologies battery recycling facility, are powering ahead. It’s already processing recalled or end-of-life car batteries. “We want to be able to create the circular economy so that the batteries we produce are the greenest possible batteries,” says CEO Benoit Couture, echoing the provincial government’s larger goal.

It’s an important cog in Quebec’s aspirations, however they materialize. Regardless, the EV economy will keep driving forward.

Natalie Alcoba is a Buenos Aires–based journalist and senior editor at Corporate Knights.