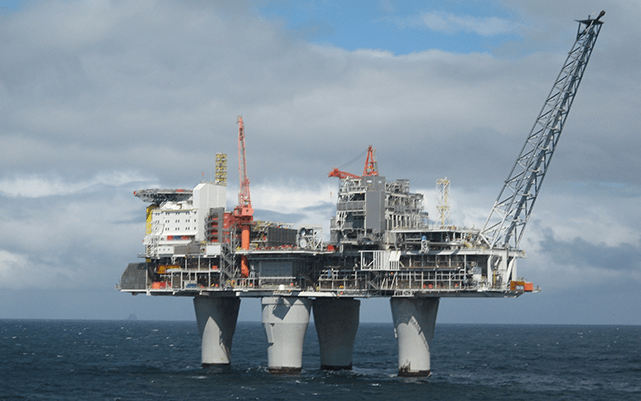

In the summer issue of Corporate Knights, contributor Eric Reguly showed us how Norway outclassed Alberta in a comparison of how the two jurisdictions have managed their enormous fossil fuel fortunes.

The Alberta Heritage Savings Trust Fund has grown by less than $5 billion since the late 1980s, equivalent to an increase of about 25 per cent. Norway’s “oil fund,” as it’s best known there, is the largest sovereign wealth fund in the world, passing 4,000 billion Norwegian krones earlier this year (over $680 billion) and amounting to a 25 per cent increase since only 2010.

A closer look at the Norwegian fund, however, reveals a bubbling controversy.

From a solely financial perspective, concerns over the fund are anchored in 2025, when interest is projected to hit a peak and begin declining. In 2001, the Norwegian government implemented “the fiscal rule,” which limits use of the fund in the national budget to 4 per cent. The rule was intended to keep fund withdrawals lower than interest – around 4 per cent at the time – ensuring continued growth. Today, Norwegian economists and other experts in the field are speaking out against the rigidness of the fiscal rule and what they argue is an overall inefficient and unsustainable spending strategy.

“It seems to be a plan that is giving this current generation all the benefits and future generations more of the costs,” says Hilde Bjørnland, an economist at BI Norwegian Business School in Oslo. In January, Bjørnland gave the keynote address at the annual general meeting of the Confederation of Norwegian Enterprise (NHO), where she warned against a swelling oil dependency. In 2009, the Norwegian government increased use of the fund in the national budget to about 5.5 per cent to mitigate for the international financial crisis – a move Bjørnland says most economists agreed made sense, and which the fiscal rule allows for during economic downturns.

The issue, Bjørnland told the NHO conference, was that while the percentage of the fund being used has been cut back to around 4 per cent, the absolute amount being used has not. On the contrary, that amount has ballooned as the fund continues to grow. A large portion has gone to boosting public employment, while jobs in the private sector have dwindled. Under the current government, now at the end of its second four-year term, the number of public employees has risen by more than 10 per cent, with soaring salaries to boot.

Hence, once interest on the fund begins to decrease around 2025, Bjørnland explains, something will have to give. That something could mean tax hikes or depleting the oil fund, but it could also mean cuts to public employment and to the famously comprehensive Norwegian welfare system, which has helped put Norway at the top of the United Nations’ Human Development Index every year since the UN began releasing the ranking annually in 2000. Combined with productivity loss and public health and pension expenses from an aging population of baby boomers, a decline of the oil fund hints at austerity for today’s Norwegian youth.

Bjørnland is far from the only one in her field to raise alarm. She is joined by, among others, the head of Norway’s central bank, Øystein Olsen. In his last annual address, Olsen said the limit should be reduced from 4 to 3 per cent.

“[The fiscal rule] is first and foremost a symbol,” says Hans Henrik Ramm, a deputy minister at the ministry of oil and energy during the early 1980s and currently a financial consultant to the energy sector. The rule, he says, “is defended by economists and very many politicians who think it was difficult enough to get it established and to get people to understand that there are limits to how much money can be used.”

Environmentalist criticism of the fund’s use now also frequently includes an economic facet. This summer, the Norwegian wing of the World Wildlife Foundation published a map showing the fund’s investments in 147 of the world’s largest fossil fuel companies. Together, these companies produce over a hundred times as much carbon emissions as Norway itself.

Clearly there is a contradiction. The Norwegian government, on the one hand, leads the world in climate-friendly public policy. On the other hand, it finances its operations in part through investments in the world’s most climate-unfriendly companies – not to mention companies with poor human rights records. WWF and other NGOs also point to the financial risk of heavy dependency on oil.

“It means that you basically have more eggs in the same basket, and the eggs are growing larger, which means a higher possible downturn,” says Lars Erik Mangset, an economist and head of WWF’s oil fund divestment campaign. Mangset says Norway should be looking to other large investment funds at home and abroad, national and public, which are reducing their holdings in companies that rely on high fossil fuel production and price levels to be profitable, while investing more in renewable energy.

WWF proposes that 5 per cent of the fund be invested directly in renewable energy projects and that investments in the most carbon-intensive parts of the energy industry – Canadian oil sand ventures, for example – be withdrawn. They are also calling for Norway, which thanks to the oil fund is the world’s largest state investor, to use its ownership more actively in pushing companies to go green.

In June, Former Norwegian Prime Minister Jens Stoltenberg agreed that the spending limit on the oil fund should be reduced from 4 to 3 per cent. This was a break from years of the political parties in power refusing any notion of tampering with the fiscal rule.

With federal elections having occurred in September, however, none of the biggest parties campaigned for an overhaul of the fund to the extent that experts like Bjørnland, Ramm and Mangset are calling for. Not when less complex, more populist causes, such as road improvements, were competing for voters’ attention.

One thing, though, is clear: Unless Norwegians and their elected officials acquire a sense of urgency about adjusting use of the oil fund soon, what has been a blessing to past and current generations may turn out to be a curse on the next.