This is an historic transition – think big!

Investment is set to double and redouble in clean energy in the 2020s, as the world makes a historic transition away from fossil fuels, internal-combustion-engine (ICE) vehicles and combustion technology in general.

The energy and climate transition in Canada requires $1 trillion in capital expenditures in the next eight years, and another $1 trillion after that.

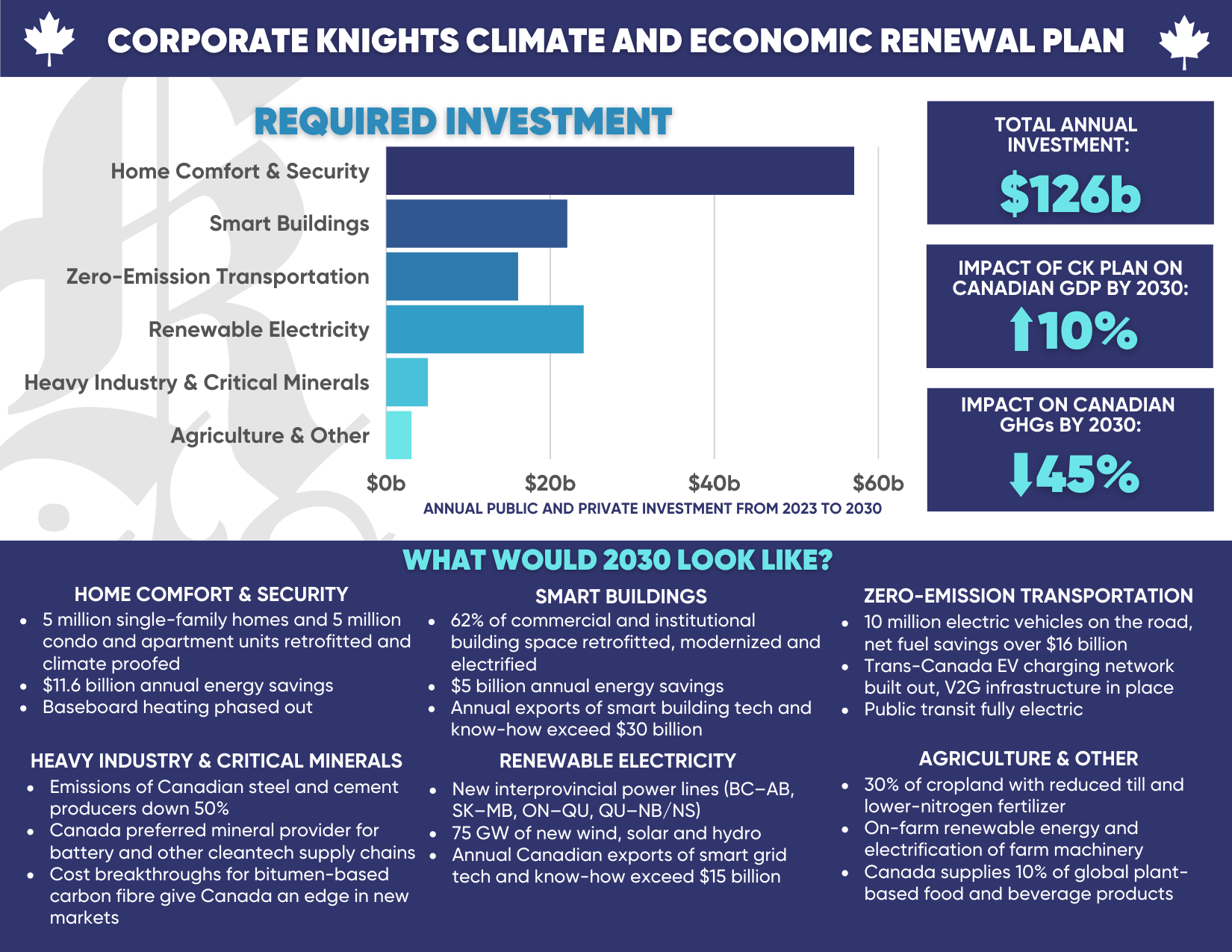

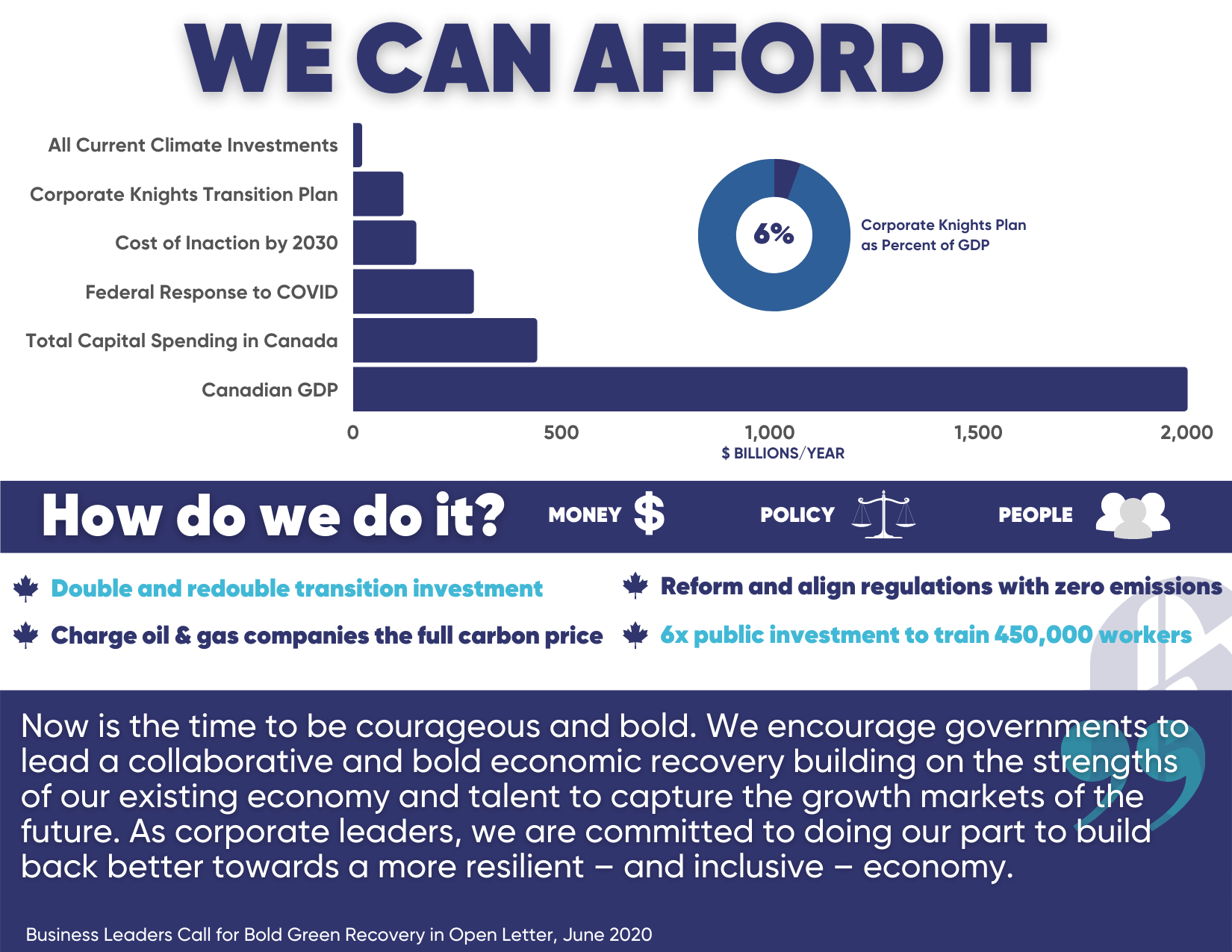

The Corporate Knights Climate and Economic Renewal Plan includes capital investments averaging $126 billion per year over the 2023–2030 period. The federal government estimates the transition will require $125–$140 billion per year, and RBC estimates the transition to net-zero by 2050 will require investments totalling $2 trillion.

Current investment in the transition is $15–$25 billion per year.

Smart buildings, smart money

- Innovations in public policy, business models, retrofit industrialization, risk management and financing are needed to make the existing building stock resilient and climate-friendly on a timeline that aligns with our emission targets.

- Modernizing the $8 trillion in Canadian residential and commercial building assets is essential to a low-carbon transition. Current capital expenditure on building renovations in Canada is $80–$100 billion per year but will need redirection and growth to cover the $75-billion annual investment needed to bend the emissions curve. Fuel and electricity savings would reach $17 billion per year by 2030 at prices that prevailed prior to the recent increases.

- Smart, climate-resilient building technologies and management systems will grow to be a $2 trillion per year global market in the 2020s. Integrated, whole-building retrofits of residential and commercial buildings

- Efficiency upgrade and electrification via heat pumps

- Smart building technology, digitized sensors and controls, integration of electric vehicles, distributed generation, storage

- Climate change resilience measures (air conditioning, flood protection, wind-proofing

Electricity sector transformed

- The grid is transformed in the low-carbon future. Globally, electricity will overtake oil as the largest source of end-use energy.

- Priorities include strategic interprovincial connections; solar- and wind-capacity expansion; integration of distributed energy, storage, EVs, microgrids.

- Growing the supply of carbon-free electricity is essential in any feasible path to meeting our emission targets, but the growth in needed new supply can be moderated by improving the energy efficiency of buildings, phasing out resistance heating, and switching out decades-old fans, pumps, motors and lighting systems for modern efficient systems with digitized control and smart energy management.

- In Canada, the supply of carbon-free electricity is not evenly distributed. New interprovincial connections are needed to allow Canadian electricity markets to trade freely in low-carbon solutions.

- Canada should aim for at least $15 billion/year in export sales in the global electricity systems markets by 2030.

Electric vehicles and infrastructure

- The electrification of transport is essential to meeting our climate change goals and will define change for the auto industry throughout the 2020s and beyond.

- In the Corporate Knights plan, there are 10 million EVs on the road by 2030, the fast charging network will be built out across Canada, and vehicle-to-grid (V2G) technology will be an established component of the new, smart grid.

- The burgeoning global market for EVs will exceed $1 trillion by 2026, and the market for lithium-ion batteries is expected to exceed US$100 billion by 2030.

Critical minerals for the energy transition

- As tailpipe and chimney emissions decline and eventually reach zero, the energy market will grow to account for 50% or more of all copper and nickel consumption and 20–40% of rare-earth minerals and will dominate the markets for lithium and cobalt.

- Manufacturers will be seeking reliable, secure, ethically and sustainably produced mineral inputs, and the global market will exceed $300 billion by 2030.

- Canada’s mining industry uses cleaner power than any of its major competitors and has a reputation for being committed to socially, economically and environmentally sustainable mining.

- Canada can leverage its position as a leading mining economy to develop downstream value-added applications in areas such as battery manufacturing.

Heavy industry

- The race is on for the achievement of zero- or low-carbon steel and cement production, and the Corporate Knights Climate and Economic Renewable Plan envisages a 50% reduction in greenhouse gas emissions from these industries by 2030.

- If the expected cost breakthroughs in carbon fibre production can be achieved, asphaltene-rich Canadian bitumen could form the basis for an $80–$100 billion industry and an important part of the conversion strategy for the oil patch.

Agriculture in a low-carbon future

- Regenerative agriculture that restores and maintains productive soils while reducing reliance on nitrogen fertilizers and other fossil-fuel-intensive inputs will be the key to aligning agriculture with our emission-reduction targets.

- In the Corporate Knights Climate and Economic Renewal Plan, 30% of agricultural land is converted to low-till cultivation practices by 2030.

- Recent high growth rates in the plant-based protein sector are projected to continue throughout the 2020s and could make up nearly 8% of global protein markets by 2030, with a value of over US$162 billion, up from US$29.4 billion in 2020. Exports to the U.S. boosted Canadian plant-based food sales by 25% in 2020, making it a $650-million industry.

| REQUIRED INVESTMENT | NOTES & SOURCES |

|---|---|

| Home Comfort and Security | Based on the average of the low- and high-cost scenarios for retrofitting the residential stock by 2035, in Efficiency Canada’s Retrofit Mission analysis. The $57 billion/year capital expenditures from 2023-2030 reflect an emergency response to climate change in which 62% of the stock would be retrofit, converted to heat pumps, and climate proofed. Retrofits include thermal efficiency gains of 40-60% depending on the age and type of building. The carbon intensity of provincial grids in 2030 are near current levels except for Alberta, Saskatchewan, and Nova Scotia where it declines to the 450-500 g/kwh range, and Ontario where it increases to 70 g/kwh by 2030. https://www.efficiencycanada.org/retrofit-mission/ |

| Smart Buildings | Based on the commercial and institutional building analysis in Efficiency Canada’s Retrofit Mission analysis. The $22 billion/year represents the incremental capital expenditures for retrofitting and electrifying over 400 million square metres of floor area. Building thermal efficiency improves by 35%, lighting and HVAC systems are upgraded, and smart building technologies area deployed in the modernized stock. https://www.efficiencycanada.org/retrofit-mission/ |

| Zero emission transportation | Updated analysis of Corporate Knights’ 2020 Build Back Better strategy for transportation. By 2030, 100% of new personal vehicles (cars and light trucks) are electric, as well as all public transit and school buses. Heavier trucks lag by a few years but by 2030 75% of new truck sales are electric. A fully built out pan-Canadian charging network is in place, V2G is an important element of smart grid operations, and an additional 2,000 km of bicycle rights-of-way and infrastructure support a 1.5% increase in active transportation mode share. https://corporateknights.com/transportation/white-paper-building-back-better-green-mobility-wave/ |

| Renewable Electricity | Updated analysis of Corporate Knights 2020 Build Back Better strategy for completing the greening of Canada’s grid. https://corporateknights.com/responsible-investing/building-back-better-green-power-wave/ |

| Heavy Industry and Critical Minerals | Updated analysis of Corporate Knights Forthcoming |

| Agriculture | Updated analysis of Corporate Knights 2020 Build Back Better with Nature Based Solutions. https://corporateknights.com/natural-capital/building-back-better-nature-based-climate-solutions/ |

| WE CAN AFFORD IT | NOTES & SOURCES |

| All Current Climate Investments | Government of Canada, Budget 2022, p. 105. https://budget.gc.ca/2022/pdf/budget-2022-en.pdf |

| Corporate Knights Transition Plan | As per the firsts section of this table. |

| Cost of Inaction by 2030 | The economic costs of severe weather and other climate change-related events are growing and projected to reach 20% of GDP by 2050. These estimates are highly uncertain as the impacts themselves are non-linear and unprecedented. We have assumed that the economic costs of inaction on climate change will reach $150 billion by 2030, or 6% of a projected 2030 GDP of $2700 billion. |

| Federal response to Covid | Parliamentary Budget Officer, Budget 2022: Issues for Parliamentarians. A total of $576 billion in new spending in the first two years of the pandemic, including $371.5 billion for the pandemic response plan itself and $204.5 billion for additional measures. https://distribution-a617274656661637473.pbo-dpb.ca/2affe02238780197b2f57fd99bf0090bab48daaf6c30a157176c3ba0b227b791 |

| Total capital spending in Canada | Globaleconomy.com. Investment accounted for 22.0 % of nominal GDP in March 2022 but varies on seasonal and annual time scales. its Nominal GDP in Mar 2022, compared with a ratio of 24.1 % in the previous quarter. Over the past 50 years it has averaged 22% of GDP, including a high of 32.9% in 1966 and a low of 15.9% in 1996. https://www.ceicdata.com/en/indicator/canada/investment--nominal-gdp |

| Canadian GDP | Statistics Canada national accounts https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=3610040201 |

| Other sources: | International Energy Agency, Net Zero by 2050: A Roadmap for the Global Energy Sector RBC, The $2 trillion transition: Canada's Road to Net Zero https://www.iea.org/topics/net-zero-emissions |