Ever since ChatGPT sparked a wave of AI-chatbot mania in November 2022, the world’s largest tech companies have been locked in an arms race to develop generative tools with the same sort of rapid, widespread uptake.

While the hype cycle over artificial intelligence – which produced enormous gains in the stock market – appears to be wobbling toward a correction, the adoption rate of AI is still steeper than it was for the internet and personal computers. A global consensus has emerged among state actors, multinational corporations and tech start-ups that humanity is only going to rely more and more on assistance from AI: for composing text, creating images, writing code, making music, and all the myriad things that a good pattern-finder can do.

And to get where we’re going, we’ll need a whole lot more power.

Computing more, polluting less

AI queries consume exponentially more electricity than traditional Google searches, and so the competition to produce the next indispensable AI model has unleashed a tsunami of investment in computing infrastructure – and, by extension, giant energy projects to circumvent struggling power grids that are unable to meet the surging load growth.

There are opportunities to make these data centres some of the most clean-powered industrial projects in the country, and at competitive costs.

– Sheldon Kimber, CEO, Intersect Power

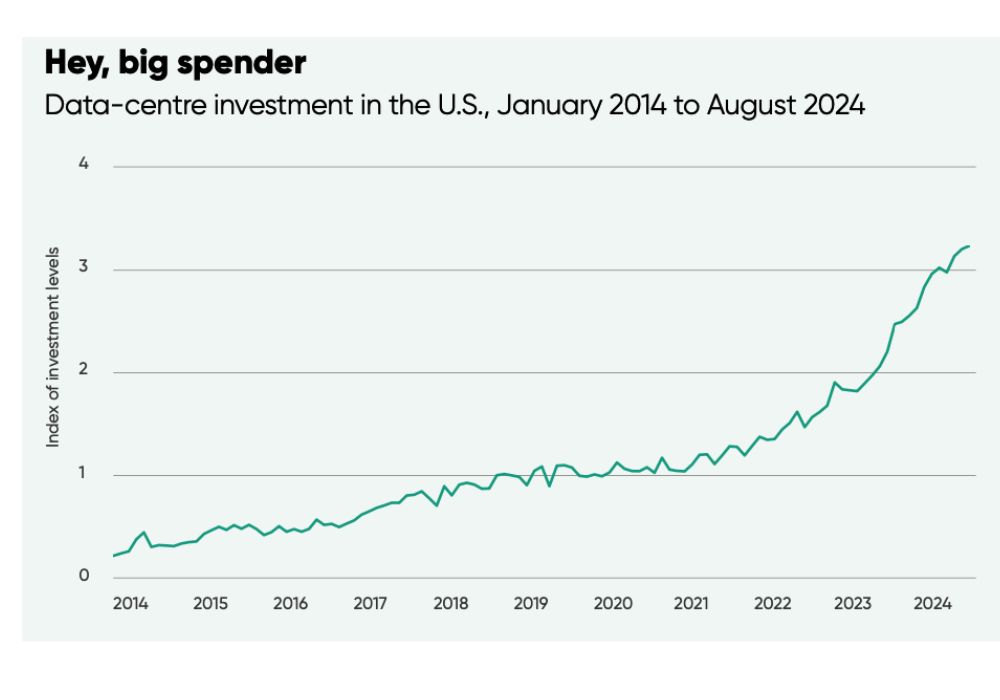

Data-centre development is primarily the domain of so-called hyperscalers, or the very large cloud services companies like Amazon, Microsoft and Google that house the data operations for global corporations. (Meta, too, runs hyperscale-size data centres exclusively for its own applications, serving its 3.35 billion daily active users.) These digital service providers had already doubled their electricity use in the four years prior to the launch of ChatGPT, and they have since poured billions into building new data centres. In October, the International Energy Agency published a report stating that annual investment in data-centre construction in the United States had doubled over the previous two years.

All that computing puts huge pressure on power grids. In Virginia, for example, data centres ate up more than a quarter of the state’s electricity in 2023. And data centres are only getting bigger, with some new projects offering up to 1,000 megawatts of capacity – enough electricity to power 800,000 homes. In September, McKinsey, the management consulting company, estimated that data-centre load may make up between 30% and 40% of all net new demand added until 2030.

The growth in data demand coupled with the limitations of the existing power grid creates an opening for renewable energy to outcompete gas to power new data centres. And the trend among big tech companies is clear: to compute more but pollute less, they are turning to renewables and battery storage. “There are opportunities to make these data centres some of the most clean-powered industrial projects in the country, and at competitive costs,” said Sheldon Kimber, founder and CEO of the clean-energy company Intersect Power, in a conversation with climate-tech investor Shayle Kann.

In December, Intersect announced an ambitious, multi-year deal with Google and TPG Rise Climate, an impact-investing firm for the climate sector. Together, they aim to deliver US$20 billion in renewable energy for co-located data centres across the United States by 2030. Intersect, which bills itself as a provider of “American-made, low carbon solutions,” was already growing fast. Its portfolio includes 2.2 gigawatts (GW) of operating solar photovoltaic systems and 2.4 gigawatt hours (GWh) of battery storage – with an additional 4 GW of solar and 10 GWh of storage breaking ground in 2025.

The rise of renewables, the persistence of gas and the rebirth of nuclear

When it comes to data-centre development, renewable sources can’t yet displace gas entirely, because of their inherent variability. Kimber estimates that when these projects are built in locations that are well-suited to wind and solar, such as the eastern panhandle of Texas, the cleanest possible mix looks like 70% to 80% renewable generation over the course of a year. Other states with strong potential for co-locating data centres with low-carbon infrastructure include Iowa, Wyoming, Indiana and Ohio, and these are where the hyperscalers are directing their investments.

Donald Trump’s return to power has boosted prospects for entirely gas-powered data centres. In January, Engine No. 1 – the activist investing firm that gained renown for pushing ExxonMobil to reduce its carbon footprint – announced it would partner with Chevron Corporation to build data centres that run on gas sourced in the United States, stunning climate investors. Their first plant is scheduled to be operational before the end of Trump’s term.

RELATED

Gas turbine delays are giving renewables an edge

What a nationwide grid network would mean for clean energy in Canada

American solar is getting a rebrand

But hyperscalers are still often steering clear of gas and sometimes turning to nuclear to satisfy their energy demands without burning fossil fuels. Last fall, Microsoft announced plans to reactivate part of the Three Mile Island nuclear plant to supply its data centres. Sam Altman, founder of ChatGPT-creator OpenAI, is betting on nuclear to power data centres. He has backed the nuclear startup Oklo, which in December signed a deal with Switch, a data centre operator based in Las Vegas, to develop reactors through 2044. In a separate deal, Oklo is partnering with the Texas-based power generation company RPower to first deploy gas generators for data centres and then phase in nuclear as it becomes available.

In December, Meta issued a request for proposals from nuclear developers “to help us meet our AI innovation and sustainability objectives.” Compared to solar and wind projects, which are quicker, easier and cheaper to build, nuclear development faces more barriers but has a longer operational life.

Meta continues to diversify its power sources. A week after issuing its nuclear RFP, the parent company of Facebook, Instagram and WhatsApp inked a deal to purchase power from four solar projects by Invenergy. In total, Meta has procured over 1 gigawatt of clean energy from the Illinois-based developer. This follows a deal in August to purchase geothermal energy from Sage Geosystems for its data centres east of the Rocky Mountains.

Meta is a major buyer of carbon credits and by this means has maintained net-zero emissions in its global operations since 2020, according to its own sustainability reporting. The company claims to have matched 100% of the electricity used by its data centers and offices with renewable energy since 2020, and wants to get to net-zero across its whole value chain by 2030.

Mark Mann is the associate editor at Corporate Knights. He is based in Montreal.