Tesla shares have been among the hardest hit in the market sell-off over President Donald Trump’s tariffs, as the carmaker’s showrooms continue to be targeted by Tesla Takedown protests and investors outraged by Elon Musk’s political activities look to move their money elsewhere.

Investors were already ditching their Tesla stocks before the universal tariffs announced last week, collectively lopping off more than a third of the share’s value since Trump took office. Tesla car sales are going down too, even as global electric vehicle sales have continued their brisk ascent, up 24% in 2024. Tesla reported a 13% drop in deliveries of new cars in the first quarter of 2025. The numbers are particularly bad in Europe, where the carmaker has sold 42.6% fewer cars so far this year compared to the same period in 2024.

The bad times come on the heels of Musk’s astounding rise to the top of the U.S. government. The CEO’s hard turn to the far right and his vote-buying largesse in the recent election helped launch him to a position of unprecedented power for an unelected official, and he’s been using his ill-defined authority to aggressively dismantle key government agencies.

But Musk’s chainsaw-wielding approach to governance, his close alignment with Trump’s authoritarian rise, and his outspoken support for extreme-right political figures in the United Kingdom and Germany have all together made him extremely unpopular on the left. While traditional investors are looking at the fundamentals and trying to avoid further losses from the brand crisis at Tesla, other investors are eliminating their exposure to Tesla on ethical grounds.

Is Tesla a responsible investment?

Last Wednesday, Toronto-based sustainability-focused financial planner Tim Nash held a webinar to answer the number one question he says he’s been getting from his clients: how to divest from Tesla?

Participants listed multiple reasons for wanting to divest: “Being invested feels morally wrong due to its connection with Musk,” wrote one. “Because Elon is unconstitutionally and illegally dismantling my government,” wrote another. “I’m thinking of USAID,” wrote another.

It’s no secret that Tesla has been a market leader in the green transition for years. But when we can tick off a wide range of problems year after year without any prospect of any improvement – in fact, quite the opposite – it is difficult to argue that we should remain invested.

– Jens Munch, CEO, Akademiker Pension

Cutting funding for the U.S. Agency for International Development has so far been the most consequential action of Musk’s Department of Government Efficiency. Internal USAID memos leaked to The New York Times anticipate two to three million additional deaths each year from lack of vaccinations. More than 130,000 deaths have already occurred as a result of cuts to USAID, according to a tracker by the Boston University School of Public Health.

For his part, Nash looks to the main ratings services for environmental, social and governance issues to make a judgment about whether to include Tesla in a responsible stock portfolio. Sustainalytics rates Tesla a “medium” on ESG factors and gives it a score of 24.8, putting it squarely in the middle of the pack for automakers. Likewise, MSCI’s ESG and climate rating service gives Tesla a BBB rating, well below its EV competitors in China.

MSCI signals issues for Tesla across all 12 of its controversy indicators and raises several ESG-related red flags, including the fact that it lacks a decarbonization target, doesn’t measure its own carbon footprint, and has had problems with product safety and quality. In March, nearly all of Tesla’s Cybertrucks were recalled for using a low-quality adhesive on some of the exterior panels.

Corporate governance is another area where Tesla is considered a laggard. Last spring, The Nation reported on Tesla’s toxic work culture, including sexual harassment and racism on the job. Musk has also been convicted in a U.S. court for violating labour law by using social media to threaten and dissuade workers from unionizing. Sustainalytics has identified 14 controversies that it classifies as moderate or significant.

Two European institutional investors have recently ditched Tesla over its labour practices. The Swedish insurer Folksam dropped its $160-million stake over union disputes, and Denmark’s AkademikerPension announced its decision to divest in March, citing concerns about labour rights and Musk’s behaviour. “It’s no secret that Tesla has been a market leader in the green transition for years,” CEO Jens Munch Holst said in a statement. “But when we can tick off a wide range of problems year after year without any prospect of any improvement – in fact, quite the opposite – it is difficult to argue that we should remain invested.”

Tesla’s ubiquity in U.S.-based mutual funds and ETFs

Tesla has long been a dominant force on the S&P 500, its valuation propped up in part by the anticipation of self-driving cars and robotaxis. Past breakthroughs and controversies surrounding the company have put Tesla’s stock on a rollercoaster of big price swings not dissimilar to the recent spike and sell-off.

Tesla stock prices last started to soar on November 7, the day Trump won the election, and then began falling quickly after Trump took office on January 20. Tesla share prices have stabilized around where they were before the election, perhaps thanks to Trump’s performative purchase of a red Model S at the White House and the promise of patriotic Tesla buyers in the United States. Bloomberg reports that the main group keeping Tesla shares buoyant is fans of Musk. The price is hovering for now in a range not far below the median of the last five years.

RELATED

Are Teslas about to become a Republican status symbol?

Meet the four most sustainable funds on the market for 2025

Why are financial advisers shunning green funds?

With a market capitalization that exceeded US$1 trillion through much of the winter, Tesla’s valuation has exceeded those of GM, Ford, Toyota and other car companies combined. But Tesla has been priced dramatically higher than its competitors since 2020. Shares in the company have a long distance to fall before they would reach even the baseline range of other major carmakers.

Because Tesla is among the largest by market capitalization on the S&P 500 and because its product is EVs, the company is included on many sustainable funds, including the Mackenzie Corporate Knights Global 100 Index ETF, which is based on Corporate Knights’ Global 100 list of the world’s most sustainable companies. Tesla ranked 45th on the 2025 G100 ranking.

“The job of our research department is to be objective as to what the company contributes toward climate change,” says Michael Yow, director of rankings at Corporate Knights. “At the end of the day, what matters with regard to our methodology is sustainable products and sustainable investments that mitigate global warming.” Labour disputes and other legal violations that lead to a proven indictment against the company could trigger an exclusion if the sum total of fines, penalties and settlements in relation to revenue is above 1%, Yow says. But so far that hasn’t happened.

Responsible ETFs that exclude Tesla

For retail investors who aren’t comfortable trading individual stocks, Nash suggests the iShares ESG Balanced ETF Portfolio, or GBAL, an “all-in-one” ETF whose holdings are filtered through ESG considerations. It consists largely of other ETFs, and of those its U.S. holding – where Tesla would normally be included – is the iShares ESG Advanced MSCI USA Index ETF, or XUSR.

XUSR excludes weapons, fossil fuels, for-profit prisons, predatory lending, palm oil, genetically modified organisms, and “sin stocks” like tobacco and adult entertainment. It also filters out companies that are involved in severe controversies. Tesla isn’t listed as a holding. “I think it’s those recalls,” says Nash, on why Tesla might be screened off the fund. Nvidia is the top holding, but other big tech companies like Apple, Microsoft, Amazon and Facebook are excluded. “A lot of those tech companies have controversies that get them screened out,” Nash says. XUSR doesn’t screen for financed emissions, so Canadian banks are included.

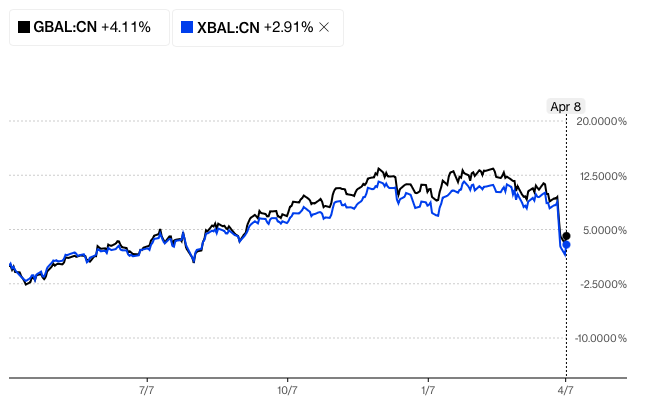

GBAL has given an 8.3% return over three years as of March 2025, and compared to XBAL, an all-in-one ETF unrestricted by ESG considerations, GBAL has offered comparable and at times superior returns over the past five years, Nash points out.

GBAL isn’t the only “one-ticket” sustainable ETF that excludes Tesla, Nash says. CI MSCI World ESG Impact Index ETF, or CESG.B, is a diversified global ETF that aligns with the UN Sustainable Development Goals and that does not hold Tesla. Likewise, Tesla doesn’t appear in the top 10 holdings of the CIBC Sustainable Global Equity Fund, or CSGE. For an ETF more focused on clean energy, the AGF Global Sustainable Growth Equity ETF, or AGSG, doesn’t have Tesla as a holding.

Correction: An earlier version of this article included an incorrect designation for Tim Nash.

Mark Mann is an editor at Corporate Knights. He’s based in Montreal.