Promising to roll back carbon pricing is emerging as one of the surest ways to accumulate votes as Canada’s political parties prepare for a federal election next year, according to new public opinion data released Sunday.

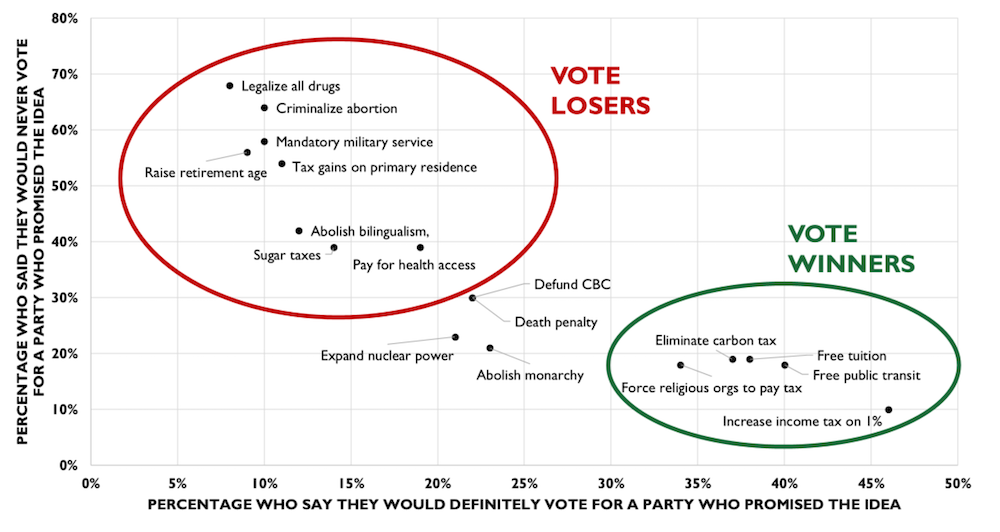

Polling by Abacus Data found that 37% of respondents would definitely back a party that wanted to eliminate the federal carbon tax and another 28% might do so, while only about one in five said they would never support the idea.

The issue was one of four that Abacus identified as a vote winner for any party that espoused it, along with increasing income taxes on the richest 1% of Canadians (46% definite/32% possible), making public transit free in every Canadian city (40% definite/31% possible), and forcing religious organizations to pay taxes (34% definite/29% possible).

“This data confirms that eliminating the carbon tax has become a vote winner for the Conservatives and a real liability for the Liberals,” Abacus says.

Conservatives “overwhelmingly love” the idea of abolishing the carbon tax, the poll showed. Liberal and Bloc Québécois supporters are likely to oppose it, though with some disagreement, while New Democratic Party supporters “are the most divided—27% say they would never vote for a party that promised to eliminate the carbon tax while 25% say they definitely would vote for such a party,” the polling report states.

The Liberals maintain that better communication and public awareness will increase the carbon price’s popularity, and the party has tried to remind voters that the vast majority of households benefit from a carbon tax through rebates. Amid low poll numbers and with the election coming up, the current government is committed to moving forward without further exemptions since pausing it for home heating oil in the Atlantic provinces.

Meanwhile, Prime Minister Justin Trudeau trails behind Conservative leader Pierre Poilievre, whose “Axe the Tax” campaign has gained momentum and won him points at the polls.

The controversy prompted Corporate Knights Research Director Ralph Torrie to call for a “grown-up conversation” about how to address the climate emergency without having a “shouting match” over carbon pricing. “The last thing the country needs is a ‘take no prisoners’ battle to the death over the carbon tax that could set back what climate progress has been made,” he wrote earlier this year.

RELATED

- Is it time to axe the carbon tax?

- Canada’s biggest emitters are paying the lowest carbon tax rate

- Canada needs to make Big Oil pay their fair share

Perceptions Skewed in the U.S.

Across the border in the United States, a skewed perception of public support for climate action is steering lawmakers away from implementing policies to address climate change, Grist reports.

Local officials especially continue to misinterpret public support for fossil fuels, even though three-quarters of Americans favour regulating carbon dioxide as a pollutant, according to polling by the Yale Program on Climate Change Communication.

Academics have studied specific cases of this disconnect. In a recent article in the journal Nature Energy, researchers wrote that locally elected officials in Pennsylvania underestimated their constituents’ support for large solar projects. Another study by Cambridge University found that congressional staffers underestimated the popularity of restricting carbon emissions in their local districts.

The misperception is partly due to a psychological bias, says Grist. But more deliberate, intentional actions by corporations are also at work to present a false narrative, with some going so far as to hire actors to indicate support for fossil fuel projects and oppose renewables at public meetings.

“What really matters, in some ways, is not objectively what the public thinks, but it’s what decision-makers think the public thinks,” said Matto Mildenberger, a political science professor at the University of California, Santa Barbara. “There’s this enormous effort by the industry to shape what politicians think the public wants.”

This article first appeared in The Energy Mix. Read the original article here.