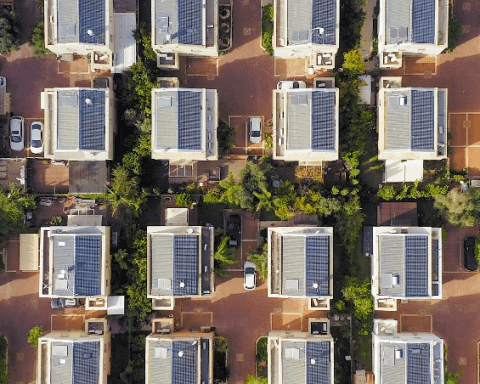

Meeting Canada’s commitment to achieve net-zero carbon emissions by 2050 will require an all-out national effort to transform our buildings from energy-wasting, fossil-fuel-gulping structures to global models of clean-energy efficiency.

The endeavour will require concerted action from governments, banks and other lenders, asset managers, developers, landlords and tenants, and individual homeowners.

“Buildings are the biggest source of emissions in cities and so a huge opportunity for meeting our climate targets … but we have to get on with this with alacrity,” Julia Langer, chief executive of Toronto-based Atmospheric Fund, told an online panel Wednesday. “We certainly see things from the perspective of ‘all hands on deck.’ ”

Langer was one of several speakers at Financing the Green Building Wave. The virtual roundtable was the last in a series called Building Back Better Together that Corporate Knights co-hosted with the Embassy of the Federal Republic of Germany in Canada.

Like Canada, Germany – and, more broadly, the European Union – is targeting emissions reductions for new structures and existing ones, including industrial, commercial, institutional and residential buildings.

In Canada, buildings account for 12.7% of annual greenhouse gas (GHG) emissions, with most of that coming from the burning of fossil fuels for heat. In Canadian cities, buildings can account for 50% of annual emissions, Langer noted.

The federal government has committed Canada to achieving net-zero emissions by 2050 and on November 19 introduced legislation that enshrines that commitment, with a number of transparency and accountability measures built in. The Liberal government has also pledged to adopt a new target for 2030 that will be more ambitious than the current pledge to reduce GHGs by 30% from 2005 levels by that year.

To meet that goal, Finance Minister Chrystia Freeland is expected to announce a number of measures in the fall economic update she will deliver on Monday, including the likelihood of grants and zero-interest loans for homeowners to invest in energy efficiency.

Earlier this fall, the Canada Infrastructure Bank (CIB) announced that it’s allocating $2 billion to help the owners of large buildings finance energy-efficiency retrofits, whether in the private or public sector.

The CIB will cover upfront costs for audits and feasibility studies to reduce risks for other investors to pursue deep retrofit projects, the bank’s managing director for investment, Frederic Bettez, told the webinar on Wednesday.

It will look to bundle projects in order to kickstart a market for project aggregators and then securitize loans and sell them off as green bonds or other sustainable finance products. Bettez said the CIB is hoping that, within five years, the market for financing large-building retrofits will develop to the point that banks and other lenders will no longer need that federal risk-sharing.

Until now, it has been energy utilities or Crown corporations that have supported energy-efficiency programs, said Brendan Haley, policy director for Efficiency Canada, a non-profit advocacy group.

Often, those efficiency efforts were meant to avoid the need for new and more expensive sources of energy supply, such as new power plants, he said. However, the appeal was limited because the goal was low-cost energy savings, rather than deep emissions reduction.

That’s changing.

Last year, the federal government allocated $1 billion to municipalities through the Federation of Canadian Municipalities, which has launched a community energy-efficiency program that supports residential retrofits. Some jurisdictions are also allowing homeowners to finance home retrofits through their property taxes.

Haley said it is critical to connect national institutions that finance deep retrofits with emerging local and regional funders, such as green banks and municipal programs, to forge a coordinated approach and a well-functioning retrofit financial market.

In Germany, 20% of the country’s annual GHGs come from buildings, Ambassador Sabine Sparwasser said. Retrofits can reduce the energy consumption of older buildings by some 80%.

“Retrofitting has become a very important part of our German climate strategy,” she said, adding that the EU is insisting its member states adopt aggressive policies. The country expects to see 200,000 jobs created over the next decade through its retrofitting policy.

It’s not just a matter of improving the energy efficiency of old buildings, but also switching fossil-fuel-based heating with heat pumps and other electric options, noted Sabrina Schulz of Berlin’s Das Progressive Zentrum.

She noted that zero-interest loans are an ineffective policy tool when rates are already so low. Similarly, tax rebates can provide benefits for higher-income homeowners who are willing to finance the work themselves, but those programs provide little guarantee that the money spent will yield real emissions reductions. Grants are critical to ensure a broad program of deep retrofits, Schulz said.

Last spring, Corporate Knights produced analysis recommending that the federal government spend $20 billion over the next two years to kickstart a self-sustaining deep retrofit ecosystem that could save $20 billion in annual fuel and electricity costs by 2030.

Langer argued that governments at all levels need to be part of the effort. Ottawa tends to provide financing, while the provinces control building codes and home building standards, and municipalities deal with zoning issues and some green standards.

While an investment in energy efficiency may pay for itself over time, there are plenty of challenges to making it happen, Langer noted. Energy costs in Canada are low by global standards – especially for natural gas – “which means retrofits and efficiency haven’t been priorities,” she said. At the same time, the disaggregated nature of the building sector – with millions of owners of individual properties – can make it difficult to achieve economies of scale.

Despite that, “the business case for deep retrofits and net-zero new buildings is positive,” Langer said. “There is a return on investment.”

While there is a lot of focus on retrofits, Canada still has a long way to go to ensure new buildings are built with energy efficiency in mind in the first place, said Andrea DelZotto, executive vice-president at Tridel, one of Toronto’s largest condominium developers.

She said building an energy-efficient condo tower can add anywhere from a 1 to 6% premium on construction costs, and the developer then has to find ways to recoup it. “There is no mechanism for developers to get back the capital they’re putting in to make these buildings work better,” she said.

Clearly, grants and other market incentives won’t be enough to decarbonize the building sector. Governments at all levels will have to adopt stricter codes and standards to drive the industry to innovate and invest.

Shawn McCarthy writes about sustainable finance and climate for Corporate Knights. He is also senior counsel for Sussex Strategy Group. With the support of the Embassy of the Federal Republic of Germany in Canada.Shawn McCarthy is an Ottawa-based writer.