More buildings than ever carry the label green, intelligent, sustainable or smart. Whatever adjective one uses to describe these shelters of the 21st century, it is the pursuit of efficiency – both during construction and over the course of operation – that is common to them all.

The U.S. Environmental Protection Agency defines the act of sustainable building as “the practice of creating and using healthier and more resource-efficient models of construction, renovation, operation, maintenance and demolition.”

From an environmental perspective, the opportunities have long been understood. The EPA estimates that buildings represent 39 per cent of total energy use, 12 per cent of total water consumption, 68 per cent of total electricity consumption and 38 per cent of carbon dioxide emissions in the United States.

Increasingly, however, the decision to build green is being driven by economics. More tenants are demanding “green” work spaces to boost employee productivity and bolster their brands, while property owners are lured to the lower operating costs and the market premium attached to such assets.

It’s why 94 per cent of architects, engineers, contractors and other building consultants are now involved in some level of green building, according to McGraw-Hill Construction’s 2013 World Green Building Trends report. Of this group, more than half are expected to get the majority of their business from certifiably green projects by 2015. The largest growth in activity is expected to come from new commercial building construction, followed by retrofits.

Impressively, in 2012 green building represented an estimated 38 per cent of all project activity worldwide. “This research suggests that green has become a business imperative,” Harvey Bernstein, a vice-president at McGraw-Hill Construction, wrote in the opening of the report.

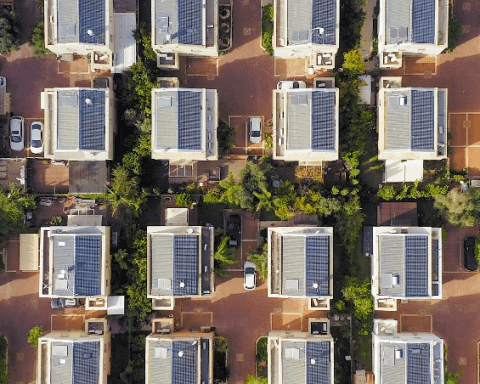

The bar on efficiency, of course, will continue to rise alongside the demand for smaller environmental footprints. Innovation will play a key role, both around the technologies embraced and the creative ways to finance greener building construction. Beyond slapping solar panels on a rooftop or installing a high-efficiency boiler in the basement, below are some areas that CK is closely watching:

Green concrete

The 3.6 billion metric tons of Ordinary Portland Cement (OPC) produced each year is responsible for about 6 per cent of human-caused CO2 emissions worldwide. Half of that cement is used as a main ingredient in concrete blocks, foundations and other products that are key materials in building construction.

Many companies have emerged with processes and products that lower the environmental footprint of the concrete used in buildings. This includes concrete formulas and manufacturing processes that reduce water and energy use and overall emissions.

CeraTech USA, for example, has an OPC-free concrete product made from 95 per cent fly ash and a renewable liquid additive that it refers to as its secret sauce. Since no Portland cement is used in its process, a major source of CO2 emissions is completely eliminated. The Virginia-based company says its process also uses 50 per cent less water.

Some other innovators in the space include U.K.-based Green Concrete Products, which makes concrete from a variety of renewable materials and waste ingredients, from fly ash to household waste to old vehicle tires; and CarbonCure Technologies, based in Halifax, Nova Scotia, which uses waste CO2 as an ingredient that is injected (i.e., sequestered) into concrete as it’s being cured.

The market for green concrete – whatever the flavour – is expected to increase at a compounded annual growth rate of 21.3 per cent between 2010 and 2018, according to a recent report from research firm Global Industry Analysts.

Born again wood

Why chop down trees when previously used lumber or rediscovered wood can do the job just fine? For building developers aiming to achieve the LEED green building certification for their projects, using so-called reclaimed wood during construction is one way to earn extra credits.

This is now big business, and Triton Logging of Saanichton, British Columbia, is among several companies supplying growing demand for previously used or “lost” wood. Triton estimates there are 300 million trees worldwide that have been submerged in areas flooded by hydro dams. It has developed machines that harvest these water-trapped trees, which are then sold and processed into lumber products.

Some companies, such as Barnwood Industries of Bend, Oregon, reclaim wood from abandoned barns and other old wooden structures. The products made from this wood are in such high demand that building materials giant Weyerhaeuser agreed in 2012 to become exclusive distributor of Barnwood’s products, which include reclaimed beams, timbers and wood flooring.

Viridian Wood Products of Portland, Oregon, looks beyond the barn. It began in 2004 by reclaiming and upcycling wood from shipping pallets and crates discarded at local shipyards. It will now take in all sorts of scrap lumber and turn it into high-value flooring, decking and panelling products.

Advanced Automation

You may have heard of the coming “Internet of things,” but what you probably haven’t heard is that most of those “things” are going to be sensors and other devices scattered throughout buildings and connected to building automation systems. Those systems are there to control lighting, heating, cooling and ventilation, with the objective of assuring comfort and safety while also reducing energy costs.

Sensors designed to sniff out CO2 from breathing or to detect motion in a room can instruct a building automation system to turn off lights and ceiling fans or adjust cooling and heating to lower energy consumption. Likewise, cleverly placed photo sensors can control inside lighting to achieve balance throughout the day with natural sunlight.

An individual building could potentially house thousands of sensors and controls. If all those things needed to be hard-wired to communicate and receive power, the costs of installing them would be prohibitive. The economics significantly improved, however, with the proliferation of energy-harvesting wireless sensors from companies such as EnOcean of Germany. These wireless sensors are powered by motion, heat or sunlight, meaning they don’t require a battery.

The number of wireless sensors or “nodes” for use with building controls is growing dramatically. Annual worldwide shipments are expected to exceed 36 million units by 2020, according to Navigant Research. But as Navigant points out, “The majority of sensors currently used in buildings are considered dumb – that is, they are incapable of making intelligent decisions in real time.”

In other words, as the data tsunami grows larger there is a need to put more intelligence into building automation systems, particularly energy management systems. Johnson Controls, Schneider Electric, Siemens and United Technologies are among the leaders in a growing field of technology suppliers focused on making buildings smarter.

Others are carving out a niche. Encino, California-based Cyber Rain, for example, has developed a smart controller for irrigation of landscaped commercial property. The controller, which can be operated remotely, automatically checks weather predictions over the Internet and adjusts watering schedules accordingly. This can result in up to a 40 per cent reduction in water use, the company says.

Efficient Products

Controlling devices and appliances efficiently is one thing, but just as important is the efficiency of the item itself – from air conditioners and air blowers to boilers and lighting.

Take the underappreciated ceiling fan. Used strategically in open spaces with higher clearance, ceiling fans can significantly reduce heating and cooling costs in a building. Like any fan, they don’t actually create cold or heat. What they do is improve circulation and, in the case of cooling, create a wind-chill effect on the skin so that air conditioners don’t have to work as hard.

When that fan is also built to operate with high efficiency, the cost savings over time can be compelling. Big Ass Fans from Lexington, Kentucky, for example, has built its reputation on the efficiency of its ceiling fans. Its bamboo-made Haiku fan is rated one of the most efficient ceiling fans in the world by Energy Star standards. When a fleet of such fans is controlled by a building energy management system – turning on and off only when people are around – energy savings can be substantial.

Efficient lighting is also a key consideration, and here the trend clearly favours light-emitting diode (LED) systems. As Navigant reports, “The market for commercial lighting is on the verge of a major transformation.” It cites falling LED prices and improved quality as driving widespread adoption. “The speed of this transformation promises to be faster than previous transformations to new lamp types, as this one technology appears likely to surpass all others in nearly every metric of quality and efficiency.”

General Electric, Philips, Osram and newcomers such as Cree are leading the charge, and commercial building owners are beginning to follow. They like the fact that LED lighting systems consume far less energy, are easy to control and dim, contain no mercury, and emit considerably less heat than traditional lighting.

One of the biggest benefits is reduced labour costs. Because the lights are durable and last for a long time, building maintenance crews spend considerably less time on ladders switching out bulbs that no longer work.

Creative financing

Innovation around green buildings isn’t just about product. Difficulty financing energy-efficiency retrofits has also been a huge barrier. Over the past few years, however, more options have emerged for hesitant building owners that ease the pain of upfront investments. In all cases, the goal is for retrofit costs to be more than covered by the long-term energy savings achieved.

The concept isn’t new. So-called energy service companies, or ESCOs, have existed for the past three decades to help commercial, municipal and other public-sector building owners, such as universities, schools and hospitals, pay for retrofits that result in permanent savings. Through instruments such as energy performance contracts, ESCOs pay for retrofits and then receive monthly payments based on the energy savings. If designed properly, the ESCO makes a healthy profit.

Johnson Controls, Honeywell, Siemens and Lockheed Martin are among the bigger companies with ESCO units. Some smaller firms, such as Ecosystem, go beyond the low-hanging fruit and push for “deep” energy retrofits that result in what Ecosystem calls “high-performance buildings that are worth more, cost less and have appealing, healthy spaces.”

Ecosystem takes what it considers a holistic approach that includes detailed analysis of heating, cooling, ventilation, lighting and other key building systems. The company notes that average energy reductions achieved from its retrofit projects amount to about 30 per cent. Others focus on specific systems. Lighting giant Philips, for example, recently launched a lighting-as-a-service model anchored by the deployment of its own LED lighting products. Along with making this option available to commercial building owners, the company is pursuing deals with municipalities looking to retrofit streetlight assets with LED fixtures.

In addition to the ESCO model, other financing options include Property Assessed Clean Energy, through which municipalities provide low-interest loans to property owners interested in energy-efficient retrofits. Those loans are paid back through a charge on property tax bills that, if a project is properly designed, will be lower than monthly energy savings achieved. Likewise, many utilities are offering on-billing financing to assist building owners seeking capital but reluctant to tie up their own balance sheets.