Three years ago, Canada enshrined its 2050 net-zero target into law. Bringing Canada’s greenhouse gas emissions to a level anywhere in the vicinity of zero, net or otherwise, in the next 30 years will require a radical departure from what we’ve seen the last three decades. Emissions today are higher than they were in 1995, and in the 17 years since they peaked in 2007 they have declined a total of just 11%.

At the heart of the climate change challenge is the dependence on fossil fuels that is built into every sector, from buildings and vehicles to power plants and farm equipment, steel mills and breweries. With that built-in fossil fuel dependence comes locked-in greenhouse gas emissions. Sure, policies and behaviour change can reduce fossil fuel use, buy time and facilitate growth of zero-emission solutions, but eliminating fossil fuel dependence requires a transformation of that capital stock.

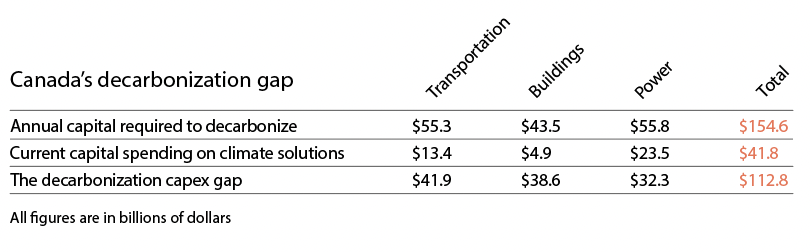

The capital investment needed to decarbonize the Canadian economy was first estimated by Corporate Knights at about $150 billion per year, and the federal government and others have since corroborated that finding. For context, this amounts to the annual total raised by sales taxes in Canada. Total capital spending in Canada runs around $650 billion per year, most of which is making the problem worse and some of which, perhaps 10%, is providing some incremental moderation of emissions. Unless and until the majority of capital spending is aligned with our climate change commitments, we will not get at the root cause of the heat waves, droughts, floods and wildfires that are eating away at our prosperity.

Such an alignment is possible. Scores of innovations in recent years have opened up pathways to zero emissions. Super-efficient and fossil-free buildings, electric vehicles, cold-climate heat pumps, smart building design and operation, electrification of industrial processes, energy storage, regenerative agriculture, circular industrial production systems, wind and solar electricity, battery storage – climate solutions are growing at unprecedented rates.

Globally, a post-fossil-fuel energy system is emerging, centred on efficiency, electrification and renewable energy. The carbon-free solutions often bring highly valued collateral benefits – better vehicle performance, healthier and more productive built environments, enhanced productivity and cost savings – that act as accelerants in the market uptake of the new technologies.

And yet, a yawning gap remains between current levels of investment in climate solutions and what it would take to get the job done. This “decarbonization capex (capital expenditure) gap” is the focus of the Climate Dollars research project at Corporate Knights. For each of the three most important sectors – buildings, transportation and power – there is an annual decarbonization capex gap of $30 to $40 billion, and the longer it takes to close it the more Canada will fall behind in the global energy transition that is underway, and the more disruptive will be the changes to our climate, our economy and our communities.

The decarbonization gap is made up of stranded opportunities – investments needed to decarbonize that are technologically and economically feasible but that are left unrealized for a host of reasons. For many opportunities, the payback is too long for private investors or is out of scope for the traditional portfolio of the public investor. Other opportunities are stranded by perceived risk, incorrect or lack of information, lack of access to capital, regulatory roadblocks, and ineffective or conflicting public policies. Cementing the problem are underdeveloped supply chains, labour shortages, the inertia and entrenched advantages of the incumbent fossil fuel industry, as well as lacklustre rates of innovation in business models and a lack of public policies for clearing the financing and logistical barriers that are holding back progress.

RELATED:

Climate dollars: A roadmap to a post-fossil fuel future

The federal government is more than $14 billion behind on climate funding

Private investors account for 83% of all capital expenditures in Canada, and the private sector has the expertise for mobilizing capital on the scale needed to respond to the climate crisis. But timely decarbonization will require increased public investment in opportunities that are currently stranded in the gap. Corporate Knights has partnered with York University’s Schulich School of Business to develop a Canadian climate-finance index that tracks and measures private-sector climate-finance flows.

Beyond the widely acknowledged need for more blended finance, closing the gap will require revising century-old utility mandates and regulatory frameworks, capturing inter-sector opportunities that are currently falling through the cracks, financing innovations to eliminate first-cost barriers, incentives and business models that avoid the half-measures that drive up costs in the long run, and a level of determination and cooperation across all sectors of society that has yet to materialize in Canada.

This is a big transition. It is disruptive, messy and full of wicked complications and pleasant surprises. But the map to a low-carbon future is taking shape, the climate imperative provides a compelling destination, and pioneering explorers and innovators are finding pathways through the decarbonization capex gap.

Ralph Torrie is the research director at Corporate Knights.