At a bustling restaurant in downtown Toronto, rumour has it Silicon Valley’s hottest innovation is here somewhere. Not the latest smartphone wedged to a diner’s ear two tables over, but a heaving burger, served up with pickles and special sauce, according the specials board. So, what does this burger do that makes Bill Gates and friends line up to throw bags of cash at it? Technically, it sizzles and “bleeds” much like any other rare burger – except no cows, or turkeys or chicken for that matter, were harmed in its making.

With trend spotters declaring “plant-based” everything the hottest food craze of 2018, all while North Americans eat more protein than ever, the market for “alt meat” is undeniably blowing up – and a growing handful of San Francisco Bay area startups with a taste for food have been leading the charge. They’re not serving up the dry soy burgers and chick’n strips of yore. No, buzzy companies like Beyond Meat (now at a growing number of Canadian restaurants), Impossible Foods and Memphis Meats are spending millions on high tech labs staffed with food scientists, biochemists and physicists to replicate “the architecture of meat,” as Beyond Meat’s CEO Ethan Brown put it. They’re running burgers under MRIs, replicating flavour molecules, splicing genes and, in the case of cellular agriculture companies like Memphis Meat, they’re brewing actual “clean” meatballs, milk, even leather in bioreactors.

Okay, so not all of that will sit well with the whole grain set, but it’s certainly caught the meat industry’s attention.

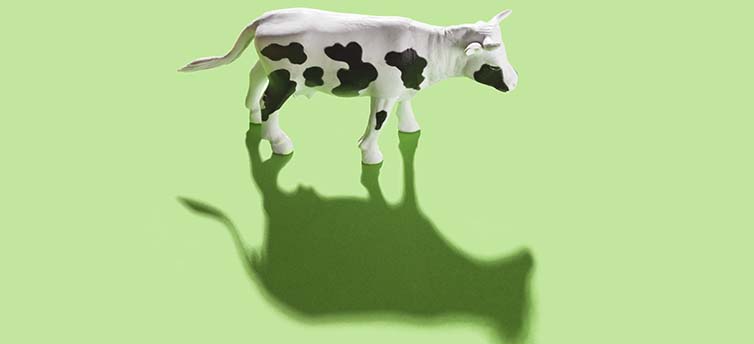

No doubt meat has needed a radical makeover. The industry’s been slammed for being a bigger climate change driver than all the cars, trucks and planes on the planet combined (not good when global meat consumption is expected to double by 2050, thanks to growing demand from developing economies). What’s more, it requires tremendous amounts of water, land and other resources, as well as controversial antibiotics and other drugs. Not to mention, industrial meat farming has spent the better part of a decade under heavy fire from animal welfare group exposes. It’s all left a bad taste in consumers’ mouths, and, as one of the globe’s largest meat processors, Cargill, put it, “[Millennials] are driving calls to do things differently.”

The thing is, until recently, fake meat, well, it’s kind of sucked. While an April study by Mintel found that an impressive 53 per cent mostly omnivorous Canadians say that they eat plant-based meat alternatives like veggie burgers and hot dogs (with one in five Canadians eating mock meat a few times a week), only 16 per cent say those alternatives “taste as good as meat.” To win over skeptics, Mintel’s associate director of food and drink, Joel Gregoire, says the makers of meat alternatives will have to bridge the taste and texture gap between their products and actual meat.

It’s a gap that’s rapidly closing thanks to this new wave of alt meat innovations emerging south of the border. Globally, the market for plant-based meat is expected to reach $4.6 billion (U.S.) in 2018 and climb to $6.3 billion by 2023. One agro-biz financier, Rabobank, has warned animal protein companies to seize the opportunity “or they will turn into threats.” So far, the world’s largest meat companies are wisely getting in on the action. Chicken processing giant Tyson Foods has snatched up a five per cent stake in one leading “bleeding” veggie burger maker, Beyond Meat. It, along with Cargill, also secured a minority investment in Memphis Meats, the San Francisco startup growing clean beef, chicken and duck meat from animal cells. Cargill, by the way, sold its last two remaining feed yards last year, to, in part, “explore plant-based protein, fish and insects.”

Not to be outdone, Canada’s largest packaged meat provider, Maple Leaf Farms, has purchased two popular plant-based protein companies, Field Roast and Lightlife Foods, boldly noting, “This acquisition advances Maple Leaf’s vision to be the most sustainable protein company on earth, including a core strategy to diversify into plant-based protein.”

Maple Leaf Foods CEO Michael McCain has acknowledged that the food industry is “pivoting towards a crisis,” ceding that the planet’s limited resources can’t sustain current dietary trends for a growing population. McCain told the Globe’s Report on Business magazine that while consumers want to ingest more protein, “they want more choice in the proteins they consume [and] the majority of that growth in North America will come from plant-based proteins, not animal proteins.” It seems Maple Leaf is effectively pulling a Patagonia, encouraging its customers to buy less of its products – its meat products anyway. Said McCain, “We’re the only meat company in the world that is overtly expressing the objective for consumers to eat meat in moderation.”

There’s no denying investing in slaughter-free products is a smart way to bank some good PR and to warm relations with most animal welfare orgs. Though some vegans have accused their favourite plant protein brands of selling out and sleeping with enemy, Mercy for Animal’s communications director, Kenny Torrella, doesn’t see it that way. “[These meat companies] see the writing on the wall. There’s more and more awareness about the unsustainability of our high meat consumption both in Canada and the U.S. Rather than being disrupted by it, they want to be part of the disruption.”

Adds Torrella, “Ultimately, for major meat and food companies, their bottom line is making money.”

And analysts note there’s plenty more money to be made. The market for alternative meat could claim up to a third of the protein market by 2054, according to Lux Research, as more “flexitarians” and “reducetarians” moderate their meat intake. No wonder Walmart is asking its suppliers to make more meat-free fare and, Nestle, the world’s largest food and beverage company, snatched up Sweet Earth to start selling its Benevolent Bacon and Harmless Ham.

Even so, not everyone’s embracing the tectonic shifts afoot. American cattle ranchers have made it clear they have a major beef with plant-based and lab-grown meats. Back in February, the U.S. Cattlemen’s Association filed a petition with the U.S. Department of Agriculture requesting that the feds establish labelling requirements that outlaw “products not derived directly from animals raised and slaughtered” from using terms like “beef” and “meat.”

Missouri lawmakers have already introduced a meat industry-friendly bill that “prohibits misrepresenting a product as meat that is not derived from harvested production livestock or poultry.” They’re particularly threatened by lab-grown meat, which could be on shelves by the end of 2018, if vegan mayo maker Just delivers on its promise to be selling a cultured avian product, or maybe lab-grown foie gras, by then. (That would place it years ahead of cellular ag competitors like Memphis Meats, Israeli startup SuperMeat and even Finless Foods’ much-anticipated fish fillets.) Just is also vowing to be one of the first clean meat firms to culture that meat without pints upon pints of controversial fetal bovine serum, the “miracle juice” behind most lab-grown meat.

Whichever cultured meat hits Americans’ shelves first, since it would be classified as a “novel” food in Canada, it’ll need Health Canada’s approval before it’s permitted on menus here. Ditto for Impossible Food’s “bleeding” wheat and potato protein burger, which gets its deceptively meaty taste and aroma from a genetically modified yeast protein, yet to be cleared by Canadian authorities.

Which begs the question, are all these new options a tad too processed? Mintel’s survey found that 21 per cent of Canadians already think so. But it depends how you look at it, says Alison Rabschnuk, with D.C.-based Good Food Institute, Mercy for Animals’ burgeoning sister nonprofit that incubates and promotes plant-based and clean meat innovation around the globe. “If you’re chicken on a farm you’re typically pumped full of antibiotics because you’re in such crowded conditions and you’ve been genetically modified to grow to the point where…you can barely stand on your two legs. That to us is what processed food really looks like.”

Adds Rabschnuk, “It’s really up to the consumer to decide what they can bear.”

Either way, if new-wave alternatives to traditional meat are as tasty as the special sauce-laden Beyond Burger selling out at that downtown Toronto eatery, Bill Gates is likely right in calling it “the future of food.”

Homegrown: Canadian Prairies feeding pea protein craze

For years, fake meat mostly got its protein from one crop: soy. Now, a second-generation plant protein source is on the rise: yellow peas. Beyond Meat’s burgers, Sophie’s Kitchen’s vegan scallops and Good Catch’s upcoming fish-free tuna all fold pea concentrates and isolates into their recipes – as do a growing array of high protein snacks, powders and pet foods. And as the world’s largest producer of yellow peas, Canadian pea farmers are poised to cash in on the trend. Much of those peas currently get processed into protein concentrates in China, but the race is on to build capacity locally.

Last September, Avatar director and environmental advocate James Cameron showed up in rural Saskatchewan to announce that his company, Verdient Foods, is building North America’s largest pea protein plant southwest of Saskatoon. Manitoba and Alberta are getting new processing plants, too. The push for more Canadian peas couldn’t come any sooner for Prairie farmers left holding the bag ever since their top customer, India, slapped a 50 per cent tariff on yellow peas earlier this year. More silver linings: Since yellow peas aren’t genetically modified, they should stir up less controversy than alt meat’s old soy standby.